Yearly Mortgagor Report – A study sent to this new mortgagor annually. The fresh statement suggests exactly how much try paid-in taxation and notice inside year, in addition to kept mortgage loan harmony at the end of the season.

A number of the can cost you you spend at the closure are factored into the Apr for easy review. Your genuine monthly payments are derived from the latest unexpected interest, maybe not the brand new Annual percentage rate.

Application – The whole process of obtaining home financing. The expression “application” generally makes reference to a type which is used to collect financial guidance of a debtor by the a loan provider.

Basically a deposit try gathered to purchase will cost you of an assessment and you may credit file and may or might not be refundable.

Annual percentage rate (APR) – To really make it more comfortable for users evaluate home mortgage attract costs, government entities developed a simple style called a keen “Apr” otherwise Annual percentage rate to include good interest having testing looking objectives

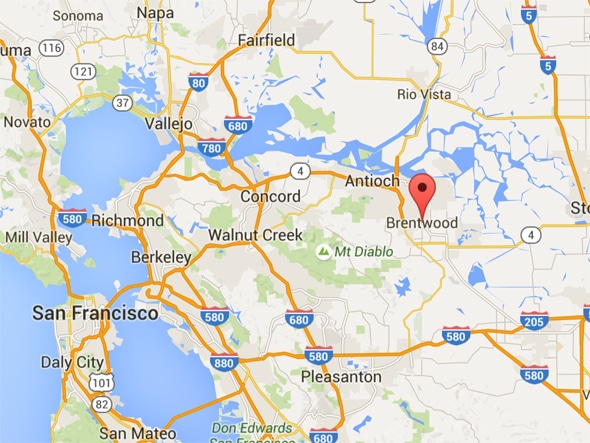

Assessment Commission – So you can verify that the value of your house supports the mortgage matter your demand, an appraisal could be ordered of the bank. The new appraisal are performed of the a specialist that is familiar that have home values in the area that will or may well not require an inside examination of the property. The fee into assessment is often passed away on debtor by bank. In regards to our testing aim, the fresh appraisal percentage is actually a 3rd party percentage.

Appraised Well worth – A viewpoint out-of an effective property’s fair market price, considering an enthusiastic appraiser’s training, sense and you will data of the home.

Prefer – A boost in the worth of a property on account of alter in the markets conditions or other reasons. The contrary out-of decline.

Comparison – The entire process of setting a value for the possessions on strict aim of income tax. May make reference to a good levy facing possessions to own a separate objective, including an effective sewer comparison.

Advantage – Anything of monetary value which is owned by men. Possessions were houses, personal property, and you can enforceable claims against other people (as well as bank accounts, stocks, mutual money and the like).

Assumable Financial – That loan without becoming paid-in full should your home is marketed. Alternatively, the brand new manager may take more repayments on the present mortgage and you can afford the seller the difference between product sales speed and the balance toward mortgage.

Expectation Clause – A provision for the a keen assumable home loan which enables a buyer to help you assume responsibility towards home loan in the vendor.

Expectation Fee – The price repaid so you can a loan provider (constantly of the customer out of real property) resulting from the assumption out of an existing home loan.

Attorneys Viewpoint – Known as good “label thoughts”. So it percentage is comparable to the title insurance policies necessary for the newest lender loan places Gulfcrest. It is a file issued by the legal counsel checklist any liens otherwise encumbrances which will change the property which can be a matter regarding public listing. For the assessment aim, the fresh attorney advice percentage is recognized as being an authorized percentage and might be added to the fresh identity insurance or closure percentage from the specific loan providers.

The loan does not need to be distributed in full by the original debtor up on product sales or transfer of the house

Lawyer Witness – Associated with the fresh payment/closure commission. So it commission is actually practical in a number of says which can be brand new closing attorney’s commission for witnessing the fresh signing of the closure files. For the research aim, a lawyer experience percentage is considered to be a 3rd party payment and can even be included in the fresh new title insurance rates otherwise closure fee of the specific loan providers.