The aforementioned references a viewpoint which will be having informational motives only. That isn’t supposed to be economic, court, or income tax recommendations. Consult appropriate professional to have guidance regarding the personal requires.

While thinking about and work out a shift this current year, there’s two housing industry affairs which can be probably in your mind: home prices and you will financial cost. You will be thinking what is going to takes place second. Of course it is beneficial to go now, otherwise best to hold off it out.

The thing you can really do try make the best decision you could according to the current pointers available. So, here is what experts assert from the each other prices and you will prices.

step one. What exactly is Second having Home prices?

That legitimate put you can turn so you can having information on house speed forecasts ‘s the Domestic Rates Requirement Questionnaire off Federal national mortgage association a study of over one hundred economists, real estate gurus, and you will money and you may business strategists.

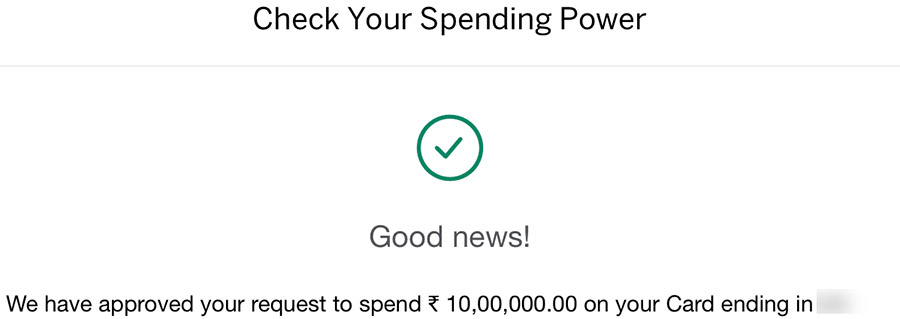

Depending on the most recent release, pros are projecting home prices continues to increase at the least courtesy 2028 (comprehend the chart below):

Because the percent away from really love may vary seasons-to-12 months, this questionnaire says we are going to look for prices go up (maybe not slip) for at least the following 5 years, at a far more regular rate.

Precisely what does which means that for your flow? If you purchase today, your house will build into the worthy of and you’ll acquire security in the years ahead. But, centered on these predicts, for people who hold off and you may costs consistently climb, the expense of a home will only getting high later on.

2. When Commonly Financial Prices Come down?

This is basically the mil-money matter in the industry. And there’s no easy way to respond to they. That’s because there are a number of products that will be contributing into erratic home loan rate environment we have been into the. Odeta Kushi, Deputy Master Economist in the beginning Western, explains:

Each month provides an alternative set of rising prices and work data that can influence the fresh new guidelines regarding financial pricing. Lingering rising prices deceleration, a slowing savings plus geopolitical uncertainty is also subscribe to lower mortgage cost. Concurrently, analysis you to definitely indicators upside risk to help you rising cost of living can lead to large pricing.

What will happen next depends upon in which all of those individuals factors goes from this point. Gurus is upbeat prices will be nevertheless come down later on this present year, however, recognize switching financial signs will continue to impact. Because the a CNET post states:

Regardless of if mortgage prices you’ll still drop after in, housing market forecasts alter continuously as a result in order to financial study, geopolitical occurrences and a lot more.

Thus, if you’re in a position, willing, and able to afford a home now, mate with a trusted a home mentor so you’re able to weigh the choices and determine what exactly is effectively for you.

Bottom line

Let’s interact with be sure to have the most recent information readily available https://paydayloansconnecticut.com/madison-center/ on home values and you will financial price traditional. To one another we’re going to talk about what the positives say and that means you makes an educated decision on your disperse.

The best way to Keep track of Home loan Rates Manner

Whenever you are contemplating to acquire property, chances are high you may have financial pricing in your concerns. You’ve heard about how they impact just how much you really can afford on your own month-to-month homeloan payment, and also you should make sure you’re factoring you to definitely in the because you plan their flow.

The problem is, using statements in the news regarding the cost not too long ago, it can be a while challenging so you can sort through. We have found a quick rundown out of everything you really need to know.

The brand new into the Mortgage Prices

Prices had been volatile this means these include jumping around a little while. And you will, you will be curious, as to the reasons? The solution are challenging given that prices are influenced by so many facts.