One of the first questions of many homeowners query is if they should get a normal financing otherwise an FHA loan. It’s a perplexing matter: there’s no single proper account folks.

Credit rating

That’s apparent considering credit rating minimums, but there is however a lot more to they than you to definitely. Home loan approvals commonly according to your credit rating by yourself.

By way of example, you aren’t immediately recognized having a normal mortgage because you keeps good 620 score. A complex underwriting formula decides whether you see criteria, and you may credit score is but one grounds.

FHA’s algorithm will agree far weaker records than simply old-fashioned. In fact, specific individuals was acknowledged with traveling colors to own an FHA financing, but become refuted conventional, despite an excellent 640 otherwise 660 rating.

Down payment

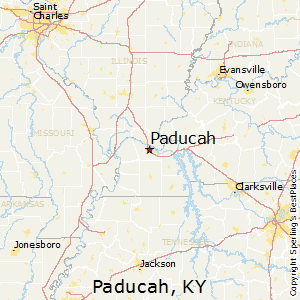

Specific traditional step three%-down applications require that you end up being a primary-date homebuyer. On the other hand, your ple, Fannie mae HomeReady means your earnings to help you equivalent 80% or a reduced amount of their area’s average, as the really does Freddie Mac’s Home Possible financial.

Debt-to-Earnings Ratios

You could have monthly payments doing 43%, otherwise both forty five%, of the revenues whilst still being be considered. Which is doing $4,five hundred in debt and you will construction payments as opposed to a beneficial $10,000-per-month income.

Yet not, people who have all the way down incomes, high debt, or to acquire when you look at the a leading-rates urban area you are going to think FHA. DTI should be 56% if the remaining file is strong.

Regarding FHA analogy, the buyer age home just like the conventional consumer, regardless of if she’s got lower income. This is actually the stamina out-of FHA.

Employment

Both antique and you will FHA want a couple of years of work records, and you can one another number amount of time in college or university coursework to the works record.

As much as possible explain jobs openings and you can frequent altering from employers, you happen to be approved more readily to have FHA rather than a traditional financing.

Financing Restrictions

None financing keeps the very least loan amount, however, each other enforce restrict loan limitations. Traditional mortgage limits try highest in most areas of the country.

Both FHA and antique financing restrictions go up so you’re able to $1,149,825 to own a 1-device family from inside the higher-prices section as well as highest to have functions which have dos-4 gadgets.

Those individuals lookin for the high-pricing elements or needing more substantial loan might prefer a conventional financing simply because of its higher limitations.

Home loan Insurance policies

https://www.paydayloancolorado.net/leadville/

Antique individual financial insurance coverage, or PMI is fairly practical for these that have good 720 borrowing from the bank score or higher. However, PMI skyrockets for those which have down credit.

Many all the way down-borrowing from the bank applicants choose FHA therefore by yourself. People having good credit pays about the same more than four age to possess old-fashioned or FHA financial insurance policies. However, anybody which have good 660 get will pay much higher will cost you to have old-fashioned PMI.

FHA means an initial home loan cost of 1.75% of the amount borrowed. It doesn’t have to be paid in cash at closing. Alternatively, most consumers wrap it into their FHA mortgage.

One more thing to imagine: financial insurance policies cancelation. You could cancel antique mortgage insurance once you reach 20% security in the home. FHA financial insurance is long lasting.

Lastly, if you intend to market or re-finance in a number of decades, antique may be the more sensible choice. Brand new initial FHA financial insurance policy is low-refundable unless you refinance toward another FHA loan.

Possessions Status

Simply speaking, the new Agency regarding Property and Urban Invention (HUD), FHA’s overseer, needs qualities to be safe and livable, while the assets are an effective coverage for the financing. As a result, the appraiser will call out safety and you will structural affairs to your appraisal. The lending company requires fixes in advance of closure.

When you are FHA is more rigorous, conventional money manage criteria also. Particular property may possibly not be financeable by possibly financing type. Although not, old-fashioned appraisers need-not call out FHA-necessary deficiencies, therefore specific attributes usually solution the standard financing assessment processes just great.

When you’re not knowing whether or not a house will meet FHA criteria, pose a question to your real estate agent to ask the fresh new residence’s factors.

Settlement costs

Settlement costs both for loan systems are investing in third-people costs which might be needed to techniques the mortgage, like the after the:

In most, these costs accumulates. 6 months out-of property taxes during the $350 four weeks would-be $dos,100 for the single item, due from the closure. Settlement costs can truly add around $seven,000 or higher on an excellent $300,000 property.

First-big date Household Consumer

When you find yourself 67% off FHA money see earliest-time homeowners, it isn’t a requirement. Some individuals have fun with FHA repeatedly because they circulate or else you desire an alternative home.

A primary-day client means anyone who has perhaps not possessed an excellent home otherwise had possession for the a house for the past about three many years.

Old-fashioned Mortgage Criteria compared to FHA: Overall

Some individuals commonly qualify for one another funds. In such a case, check this new initial and you can month-to-month price of for every single making a good choice.