Modified By the

Co-finalizing home financing pertains to a third party agreeing and work out home loan repayments in the event your client usually do not. If a hopeful home customer’s money or credit history aren’t adequate so you can qualify for a mortgage, such, they might consider in search of a trusted family member or friend to help you play the role of a home loan co-signer.

A great co-signer guarantees loan providers one their funds could be paid back, decreasing exposure and maybe convincing lenders to utilize individuals they you’ll if you don’t has refuted investment in order to.

Looking at both sides of your own formula can help you learn the full implications away from asking someone to end up being your co-signer otherwise agreeing become a good co-signer oneself.

If you’d like home financing co-signer

Qualifying to own home financing from inside the Canada actually easy. Which is partly as to why co-finalizing a mortgage can be acquired: It enjoys the new think of owning a home alive for those who find themselves pressed outside of the housing marketplace by higher interest prices otherwise rigorous financing standards.

Causes you will need a great co-signer

The reason why having in need of home financing co-signer try closely pertaining to exactly why you may well not become approved getting home financing:

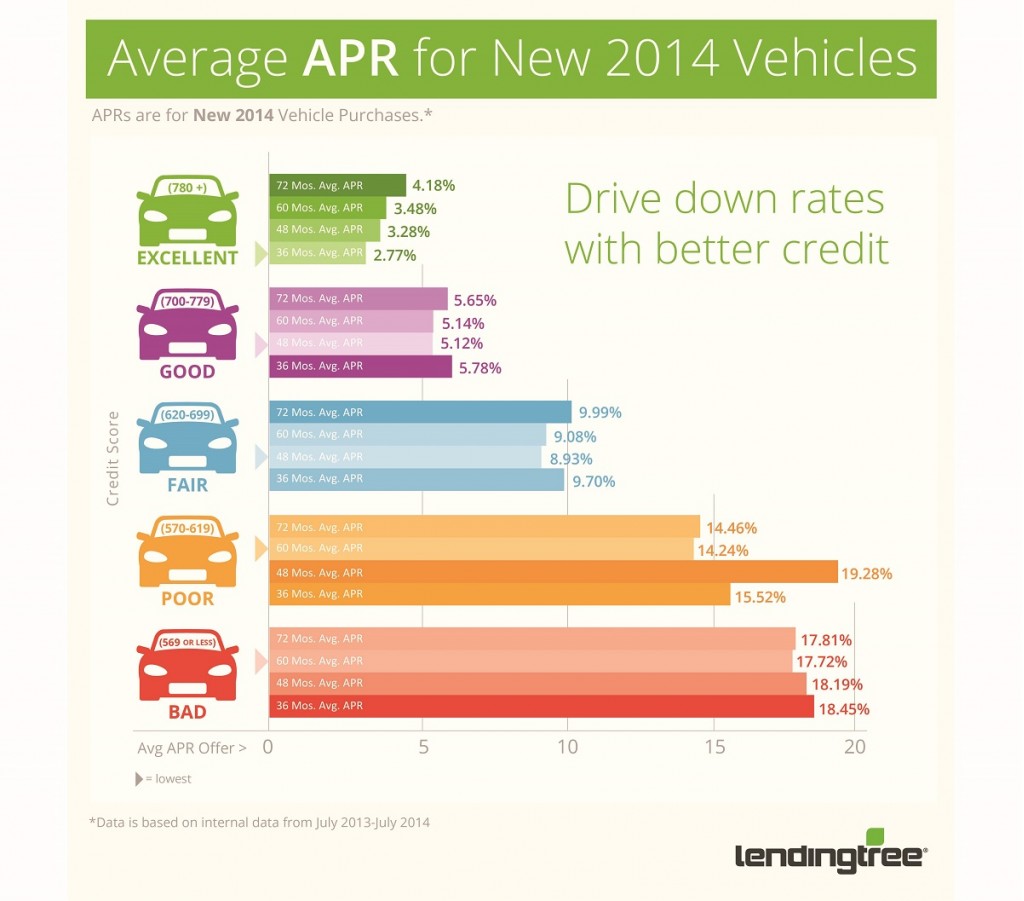

- You have got a primary, otherwise non-existent credit score. Lenders could be cautious about financing your an enormous amount of currency without having far feel repaying financial institutions – specifically Canadian creditors, if you’re a novice on the country.

- Your credit rating is actually low. The lowest credit rating can be code so you can loan providers that you haven’t create good loans-cost habits yet.

- Discover questions regarding your revenue. If you’re not earning enough, or try notice-employed and get problem indicating you build a stable earnings, a loan provider may not offer the amount of funding you prefer to-do a property purchase.

In case your borrowing from the bank try damaged due to overspending or outstanding debts, such as for instance, taking a co-signer is highly risky both for people. You’ll be taking out fully a loan you may not pay back, that could garbage your finances, and your co-signer may see the money and you can coupons based on repaying someone else’s home loan..

You really need to really only imagine resulting to an excellent co-signer when you’re confident in what you can do to pay off brand new financial yourself.

Who can be good co-signer?

Theoretically, you can now agree to become a good co-signer. Given that co-signing is a significant obligation, it’s usually just undertaken from the close friends otherwise household members, for example moms and dads, which could be way more mentally supplied to take on the child’s home loan repayments.

Becoming passed by a lending company, their co-signer need to be economically fit. Co-signers are needed having a strong earnings and you may solid borrowing score, and therefore show the lending company that they can accept new monthly obligations should you standard.

How much time does a beneficial co-signer stick to their home loan?

Unless you just take certain action to eradicate a beneficial co-signer from the home loan, they will certainly remain accountable for people unpaid home loan repayments until their home loan is wholly paid back.

Deleting good co-signer from the home loan

After you’ve owned your residence for some time as they are managing your loan sensibly, you could potentially inquire the lender to eliminate new co-signer from your own mortgage arrangement. Doing this mode taking on all obligations in making your mortgage payments, but it addittionally frees their co-signer out-of facing people risks. The financial must determine whether you really can afford their home loan repayments before removing your own co-signer.

Some lenders can charge a charge so you’re able to enhance the mortgage files such as this, very make sure you know their lender’s conditions and terms just before resulting to a good co-signer. It’s adviseable to confirm that removing a good co-signer doesn’t amount as the breaking the financial offer, that’ll cause nice penalties.

Home loan co-signer compared to. financial guarantor

While you are having problems taking a mortgage acknowledged, however they are near to qualifying, you will possibly not you desire a home loan co-signer. You might want home financing guarantor as an alternative.

The duties out of co-signers and you can guarantors is actually comparable, but there are a few tall variations that have to be understood.

If you are asked so you can co-indication home financing

Co-finalizing a mortgage to have a pal or relative is an effective big deal. Since the a co-signer, you hope to take on the brand new month-to-month home loan repayments when your number 1 borrower fails to pay. Basically, you then become a good co-borrower utilizing the same commitments as resident. Your identity also appear on the property identity.

While the you happen to be guaranteeing that a mortgage was paid off, your credit rating, credit history and income could be always reinforce an or weakened applicant’s financial software.

Trying out a major expense

The primary threat of being a home loan co-signer is you can need to use towards enormous economic weight of repaying somebody else’s financial.

Into the degree procedure, your capability and come up with such money might be checked, so the costs by themselves may not derail your day-to-day funds. Although currency familiar with pay back the fresh new financial have a tendency to started at the expense of your other savings requires, such retirement, yet another automobile or even a lot more possessions for yourself.

While you have to assume money at the beginning of the loan name, you are with the connect consistently. Navigating around that it obligations may require asking the customer to CO cash advance loans market the house before prevent of title, which could produce a great backbreaking prepayment penalty.

Restricted borrowing from the bank

Your capability so you can obtain later may also be less. The borrowed funds you co-signed will get factored into the financial obligation service percentages, so possible loan providers may think you’re overextended if you try so you’re able to availability borrowing from the bank while becoming an excellent co-signer.

Most readily useful Financial Prices for the Canada

Evaluate Canada’s best mortgage brokers and you will agents front side-by-front side and discover a knowledgeable financial rates that can satisfy your own you desire