1. Design Money are very different in order to traditional mortgage brokers

Design financing are designed to allow you the capability to create your dream household, and also so you’re able to decrease dangers of endeavor blow-out and waits. All the lender provides more procedures but generally do not anticipate to get the whole sum once you indication every documents. The borrowed funds is frequently paid when you look at the a critical regarding repayments entitled progress costs or drawdowns. These are percent of money you’ll obtain, plus it setting you’ll receive some cash every time you begin another stage on the project.

- Slab Pouring the fresh slab

- Body type Improving the body type towards the rooftop above

- Lock-right up Locking-in the shell of the property

- Utilities- establishing progressive establishment

- Latest adding finally meets and inspection to own conclusion.

dos. A careful techniques need to be used to view the money

Inserted builders need give invoices and you will a summary of its pastime towards the lenders. While you are a manager creator, you might also need to transmit invoices and you will bills before asking for the newest next drawdown. A bank assessor will likely then measure the strengthening at every stage of drawdown in order for for every single stage is accomplished, and that which you complies using their very own credit and you may judge conditions. The financial institution tend to want to material this new fee just after the auditor’s recognition.

3. It’s a good idea having a barrier for unexpected expenses

Loan providers will test out your serviceability of your mortgage and does not get better your hardly any money unless of course he has got with certainty analyzed your capability to repay. It’s always best to exercise warning with the amount borrowed and you may don’t push they on restrict. Constantly try to has actually a barrier right from the start. You might have to believe in so it for unanticipated expenditures.

When your endeavor will set you back strike aside, you should speak to your representative instantly. They can provide solid advice and have your your options. Several times, a financial encourage an equitable services. Although not, in the event that a bank claims no so you’re able to addiotnal borrowing (lending), the excess-can cost you away from completion will fall you.

cuatro. Design fund require particular files

In just about any household structure financing, the bank usually gauge the worth of your property, and check brand new estimate can cost you pertaining to product, labor, and you can design.

a copy of fundamental price for the signed up professionals or your own commission agenda in case you are a builder owner

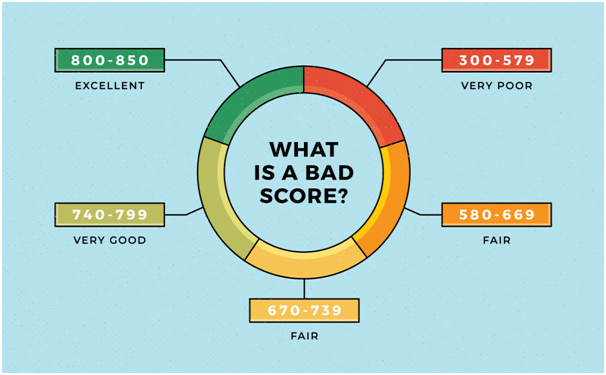

Lenders also want to make sure you are able to afford the building mortgage, so that they need information on the annual money, credit history, and you may property you own. You must help your statements with appropriate documentary facts.

5. Household Build Money bring plenty of advantages

the chance to individual another type of house, for which you need and how you need it, without the need to hold off years if you don’t decades to keep upwards the cash

peace of mind you to definitely developers can do their job – this new contractors and designers is reduced with respect to the improvements of its performs; once they provide careless qualities, the financial institution may end percentage up until enough advancements is going to be revealed

most readily useful handling of expenditures-when you yourself have a ton of cash available at you to definitely big date, you might end up being tempted to acquire prohibitively pricey factors; drawdowns avoid really borrowers getting reckless having large sums of cash

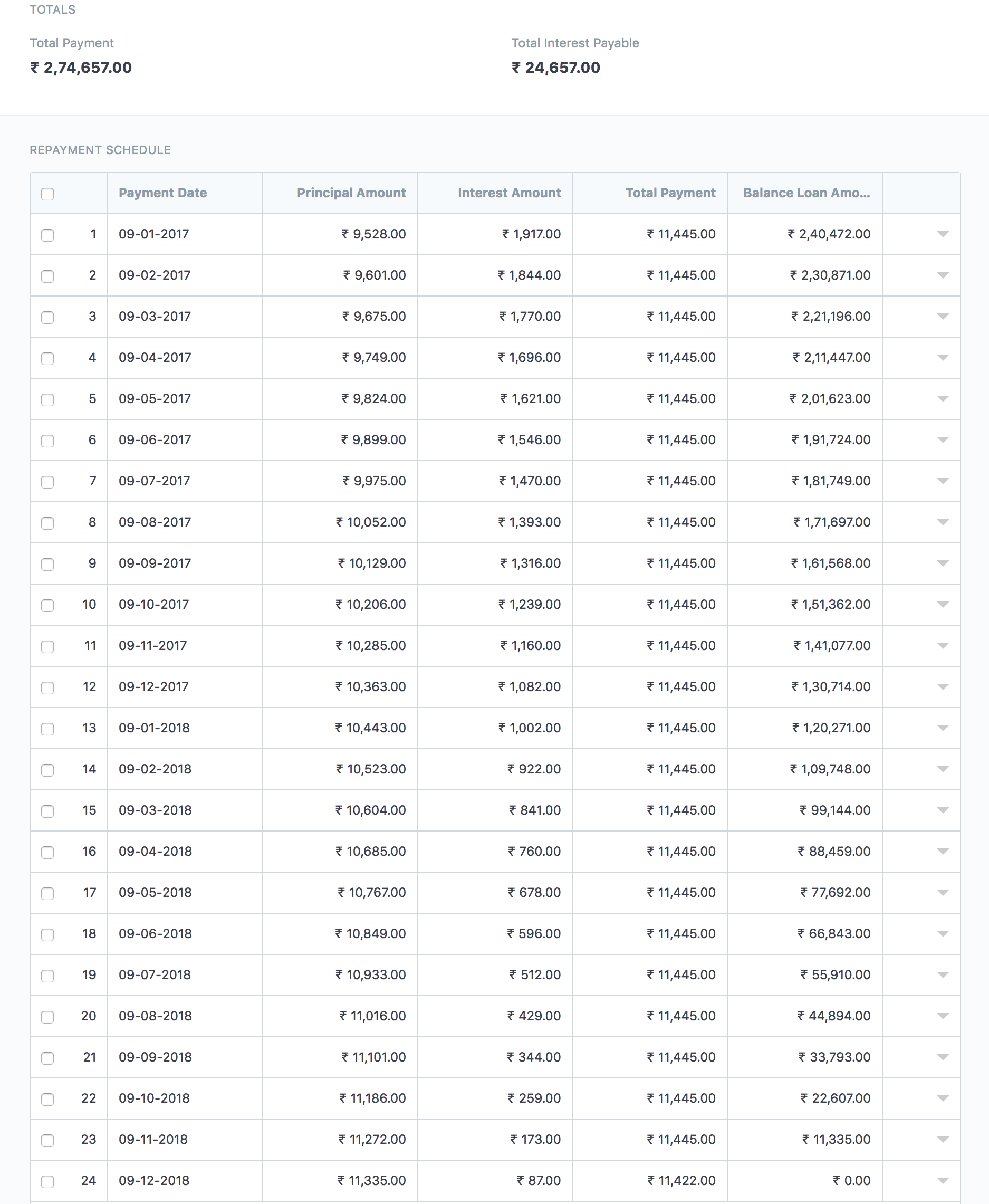

economising potential- Design funds are often attract only funds through to the design try done and you’re only recharged attract into complete matter becoming passed any kind of time provided stage of investment. It will help that have earnings throughout the a period of time in which the property is actually unlivable, or if you are unable to receive any book for it.

six. There are also a couple disadvantages to look at

You prefer a top deposit-so it enforce mostly to help you manager builder money that are thought a good riskier; you’re wanted an all the way down-payment greater than twenty five%

The level of documentation needed over the length of your panels everything you in the list above, additionally the flooring agreements therefore the blue book, hence comprises information such as the issue utilized for external insulation.

the risks out-of rising rates- very build financing are done for the changeable prices Idea and you can Focus. In the event the fundamental pricing increase, this may connect with your ability meet up with payments. It has been eg relevant in the last 18 months inside the Australian continent in which investment pricing keeps risen of the more than 1.25%. following the achievement of your renovation/ design work, the mortgage reverts in order to a basic financial.

You should always search expert advice when you decide to take such an important step. Design money would be problematic and requires the assistance of an expert. For additional information regarding build financing or renovation finance, don’t hesitate to telephone call or current email address me personally in person on [current email address secure]