Abusive Credit Methods and you will Foreclosure Protection

Predatory lending is scheduled by FDIC once the work of “imposing unjust and you may abusive mortgage conditions on borrowers” additionally the finance try disadvantageous in order to individuals. Lenders need competitive mail, cellular phone, Tv or any other types of adverts having claims from loans to help you step out of financial obligation, otherwise a false appeal mortgage rate to the home financing, punctual cash till the next salary comes in, and other types of luring in uneducated or naive borrowers.

You can now feel a target away from predatory financing. Lenders persuade individuals to commit to mortgage terms and conditions that can generate challenging to settle the mortgage or prevent they whenever called for. While a prey of predatory credit or if you suspect that financial used abusive credit means, you ought to find legal services regarding a skilled commercial collection agency safety lawyer.

The law Office of Michael P. Forbes, Desktop was seriously interested in helping website subscribers achieve the absolute best results. My corporation features aided clients facing property foreclosure, repossession of their trucks, or any other activities on account of predatory lending.

What is actually Predatory Lending?

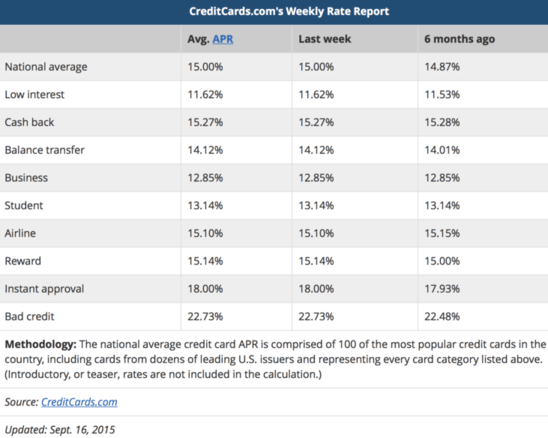

The kinds of loans always for the abusive credit practices is actually payday loan, credit cards, subprime fund, auto loans and you may overdraft money.

In the most common facts, the loan is generated according to guarantee and financial stands to profit greatly in case your borrower is unable to meet the terms of the newest debt. They work with when they is also foreclose or repossess new equity such as once the a home otherwise vehicle. A special mortgage that finally cost more compared to the real cash lent ‘s the pay day loan.

Exactly what are Payday loan?

Payday loan or cash advance payday loans was ways to rating crisis finance till the second salary. Should your debtor never pay the loan and you can adhere to this new words, the interest rate and late charge can also be build easily and also the debtor will get pay 100% or more along side existence the loan. He is small-name large desire financing.

Usually the practice of predatory or abusive lending helps make the focus off a loan come all the way down and also make they come the borrower’s ability to pay-off the loan is actually more than it really try. The results shall be financially bad for the fresh borrower. Predatory Lenders address primarily the brand new quicker knowledgeable, terrible, earlier and you can racial minorities though you can now fall target on their abusive tactics.

Unlawful and you will Abusive Lending Behavior

- Making use of the assets of borrower on basis of your financing in the place of planning regarding if the debtor is also pay off the newest obligations

- Luring a debtor in order to refinance financing many times which have earnings to lender as a consequence of activities and you will charges with every re-finance

- The use of deception otherwise ripoff to hide the bad credit payday loans guaranteed approval Idaho true character of the loan of individuals that naive or ignorant otherwise the fresh new sought out targeted borrowers

Preferred Particular Predatory Credit

- Required Arbitration Condition – borrower is bound during the recourse from the bank

- Mortgage Flipping – The lender flips the borrowed funds and each time products and charge was put into the loan

- Collateral Removing – Lender helps to make the financing against security irrespective of element of one’s borrower to repay the loan

- Hidden Balloon Commission -The new borrower learns at the closure that the loan is temporary as the borrower taken out a minimal monthly payment/low interest loan

- Bait and you can Option – The lending company helps make another financing to what is assured

- Loading – The financial institution adds activities particularly borrowing life insurance policies and you may produces the latest debtor envision brand new enhancements are needed attain the mortgage

With a lawyer handle your case inside the tips up against your bank to possess predatory financing practices can make a significant difference regarding result of your case. If perhaps you were a target out-of predatory financing into the Pennsylvania, phone call the law Place of work off Michael P. Forbes, Desktop today to own help.