Addition

Are you searching to invest in a property for the an outlying otherwise residential district city with a people away from ten,000 or faster? If that’s the case, it could be worth exploring a beneficial USDA mortgage. The latest U.S. Agency of Farming home loan system facilitate some People in the us go its homeownership desires when an excellent traditional’ mortgage could well be out of the question.

Element of exactly why are an effective USDA home loan including a stylish choice for borrowers are flexibility. Even if you not next to an enormous city, the mortgage doesn’t require that get a ranch or ranch. Qualification lies in earnings and you can area.

What is actually a beneficial USDA financing?

A USDA mortgage loan helps qualified rural homeowners get a property rather than a downpayment. Just like any most other financial, you should satisfy what’s needed. Customers can choose from the next USDA home mortgage alternatives.

The fresh USDA supplies head money to have reasonable- and also low-income individuals. Earnings criteria vary because of the place, so connecting that have a USDA bank near you is a must. People who opt for an immediate mortgage will additionally make use of competitive interest levels.

The fresh new You.S. Agency of Farming backs all USDA mortgage. Consequently, eligible consumers gain access to reduced rates and beneficial terms and conditions. The actual only real disadvantage would be the fact USDA buyers are responsible for financial insurance policies whenever they do not have an advance payment.

Outlying people is repair or upgrade their residence using this type of USDA mortgage. Specific borrowers discover several thousand dollars into the help set on much-requisite home improvements. A USDA home improvement loan will keep you against burning up the savings or placing these expenditures to your a high-appeal credit card.

All you have to see

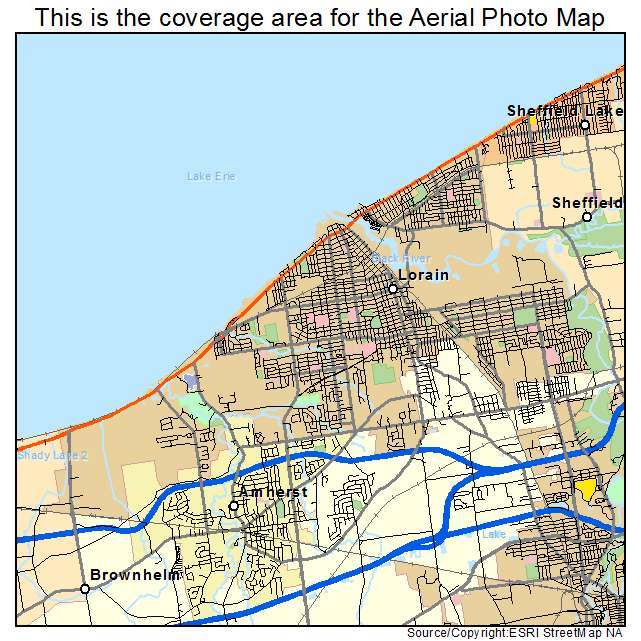

Once more, area is key. The new USDA site will help know if the house or property you will be interested within the drops in this a good USDA-qualified town. Guarantee the home is actually a condo, manufactured domestic, equipment development, or single-family home.

When you’re there are many advantageous assets to take pleasure in having a USDA financial financing, fees are inside, as well as an initial mortgage advanced and a yearly home loan insurance fee. But do not allow the charge deter you from moving forward having it financing alternative. This type of charge was less than you would shell out for the FHA home loan insurance fees, so it is a loan system that is really worth idea.

Rating Pre-Acknowledged for your Fantasy House

More individuals is to invest in the earliest house or apartment with a USDA mortgage loan. Just be sure you are aware the benefits and cons associated with mortgage program just before assuming its best for you.

Arguably the most difficult part of to buy a home is coming with a down payment. When you’re a first-date homebuyer with just minimal cash supplies, it could take many years strengthening such fund. An excellent USDA mortgage is actually a no deposit mortgage that will help you property your dream domestic reduced.

content-develop#toggleExpand” data-target=”content-grow.titleElement”> Lenient borrowing from the bank conditions

Those individuals seeking a conventional mortgaage have a tendency to need to have a robust credit score. Yet not, even though you understand your score isn’t really some properly which you have got challenges in financial trouble in earlier times, you might still qualify for a USDA home loan. That being said, it can be best for devote some time boosting your credit score before you start the program processes.

content-grow#toggleExpand” data-target=”content-develop.titleElement”> Zero prepayment punishment

Particular lenders cost you having repaying your loan early. Whether or not it isn’t once the popular whilst was once, good prepayment punishment you will lead you to rethink the decision so you’re able to cure their houses percentage. Thank goodness, there are not any such as for instance fees otherwise charges having a beneficial USDA financial financing.

content-develop#toggleExpand” data-target=”content-expand.titleElement”> Location restrictions

The top disadvantage away from good USDA financial is that you happen to be minimal so you can outlying portion. Which limitation you certainly will present specific demands together with your job or prominent lives. You can also see it a welcome alter going in the hustle and bustle regarding big city lifetime so you’re able to a slow, less noisy pace for the an outlying mode.

content-grow#toggleExpand” data-target=”content-grow.titleElement”> Income limits

As stated significantly more than, USDA fund were created to have lower income consumers. Youre no further entitled to this program in case your salary is more than 115% of one’s median earnings for your town. Run your own lender towards the almost every other choice in case it is concluded that your income exceeds USDA system constraints.

content-grow#toggleExpand” data-target=”content-expand.titleElement”> Personal home loan insurance included

Individual mortgage insurance policies, otherwise PMI, handles your lender should you prevented to make repayments. Surprisingly, PMI will add plenty towards the mortgage. But that’s an expense of several rural customers are willing to pay, especially if becomes all of them off leasing and you may using their landlord’s financial.

Simple tips to qualify for a beneficial USDA loan

Earliest, you need a credit history regarding the mid-600s. That delivers you particular step place if you’ve got some skipped money otherwise pressures with high loans stability prior to now. There’s nothing wrong having pausing your property to order go improve their score, often.

Once your credit score is actually range, you need to get a hold of an eligible property. Once more, the latest quarters have to be for the a qualified residential district or rural place so you’re able to qualify for a great USDA mortgage. The last thing you need is to fall for property only to see its outside of the geographical limits.

The very last degree pertains to your income. Your family members money must not exceed the fresh new maximum based of the USDA having the place you are interested a property. You could potentially determine your earnings qualifications with the USDA webpages.

Just how can USDA financing compare to traditional mortgages?

Traditional mortgages are notable for the aggressive rates of interest and you can reduced monthly premiums. Borrowers can choose from a predetermined rates (where the interest rate remains the same across the lifetime of the borrowed funds) or a varying rate (where the price fluctuates once a primary introductory months). The difference, even in the event, would be the fact a downpayment is required having a conventional mortgage.

Particular antique money keeps downpayment solutions as bad credit personal loans Virginia little as 5%. But you may want to set-out closer to ten% based on your debts, if you don’t 20% so you don’t need to value PMI. A traditional financing will be value exploring in the event the an effective USDA home loan mortgage has stopped being a choice.