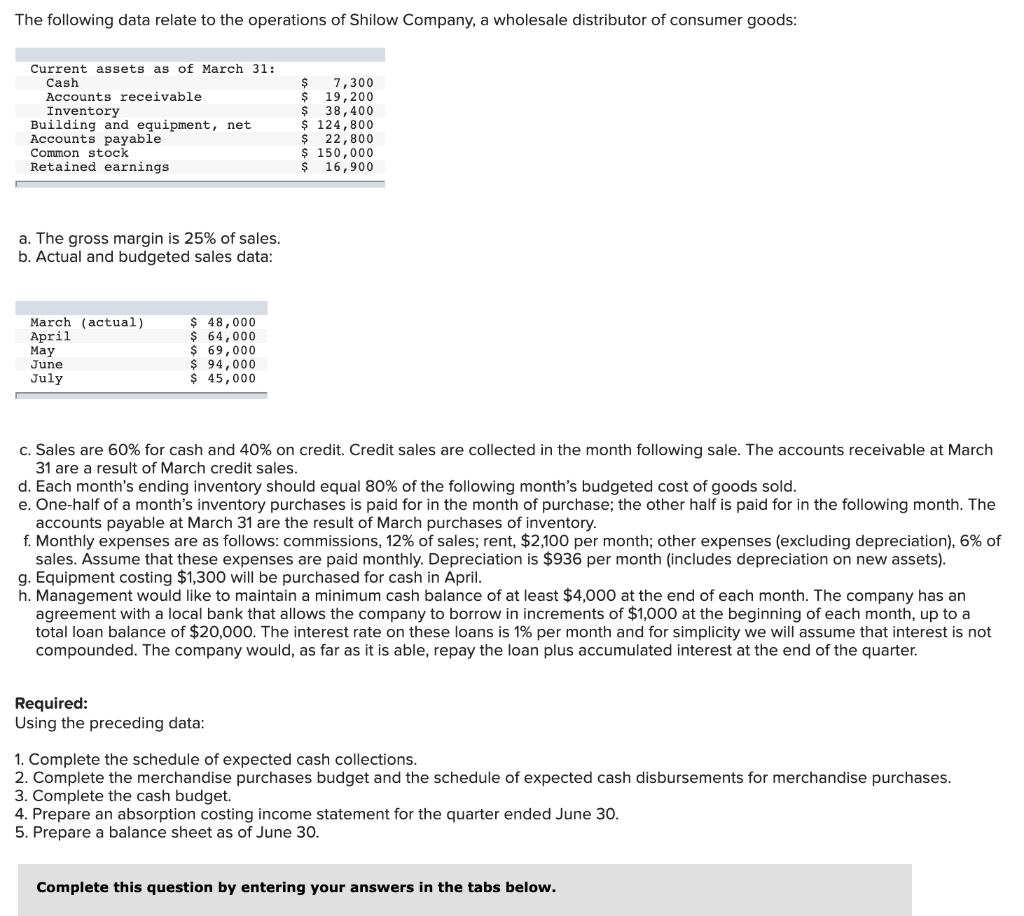

That have home prices booming across the country, it could be easy to meet with the domestic security requisite to get an excellent HELOC or family collateral financing. This means that, your home must be well worth over you borrowed towards financial to be eligible for an effective HELOC. Concurrently, there has to be security available for you to help you borrow against. Most loan providers usually accept you having a credit line if you’ve got about fifteen% to help you 20% family guarantee gathered. The amount of guarantee you have of your home will help the lending company influence the utmost size of new line of credit youre eligible to acquire. Each time you make an in-date mortgage payment, youre strengthening guarantee in your home through the elimination of the scale of one’s debt. Including, if one makes renovations you to definitely improve the worth, the house guarantee increases. Be careful one home prices change, so if you play with an excellent HELOC and you can viewpoints shed, could result in owing more on your property than just it may be worth.

Credit history

Very loan providers will demand a good credit score in order to approve your own HELOC app. Toward common measure away from 300 so you’re able to 850, your credit rating have to be well significantly more than 600 and even closer to 700 discover a great HELOC otherwise family collateral loan out-of extremely banks, credit unions or other creditors. Specific lenders, however, be more flexible in terms of your credit rating when the their house’s collateral will do and you also meet most other certification as determined by the lending company. In that case, you’ll shell out a top fixed rate and stay approved so you can use quicker how many installment payments create loan TN on your own line of credit. While doing so, lenders will usually pull your credit history and you may review they to pick regarding your history that have college loans, auto loans, credit cards and any other version of obligations you may have.

Debt-to-income Proportion (DTI)

Your debt-to-money proportion, or DTI, could be noticed before you try accepted for an effective HELOC. Specific lenders wouldn’t agree a line of credit unless of course their month-to-month costs are less than thirty-six% of the month-to-month income. Almost every other loan providers could be alot more prepared to approve an excellent HELOC actually in the event the DTI is perfectly up to fifty%. There clearly was an easy picture for calculating your debt-to-income ratio. Very first, seem sensible any monthly premiums, as well as your first-mortgage, credit card minimums, car repayment, figuratively speaking, second mortgage while some that will be due regularly. Next, separate one to overall by the gross monthly money. That is the paycheck prior to write-offs, as well as other income sources, such as youngster help, part-date services or front performances. This is the loans-to-earnings proportion equation:

Before applying to own an excellent HELOC, it’s a good idea when planning on taking strategies to reduce your own DTI by paying down expenses. You may even have the ability to improve your money for individuals who have enough time and you can capacity. These procedures will allow you to change your finances and stay in a much better reputation and also make monthly payments towards the HELOC and you will save money having upcoming need.

Money

Getting a great HELOC and you may supply dollars from your own home loan, try to meet with the lender’s income conditions. Its a requirement since your earnings plays a crucial role from inside the what you can do to pay debts. Money requirement varies according to lender or borrowing from the bank relationship, but don’t assume them to list a particular money you prefer to make. Loan providers commonly demand duplicates of the paystubs or taxation data to verify your revenue in HELOC application procedure, so it’s a smart idea to collect you to definitely advice ahead of time.