- Active-Obligation Services Users

- Honorably Discharged Veterans

- Qualifying People in the latest Federal Guard otherwise Reservists

- Eligible Surviving Spouses

Such as FHA fund, you’ll want to live in a minumum of one of your own devices on your own when you need to explore Virtual assistant funding to invest in a beneficial rental property. However, immediately following per year, you might be able to sign up for a separate Virtual assistant mortgage into a unique property and you will do this again.

USDA Financing

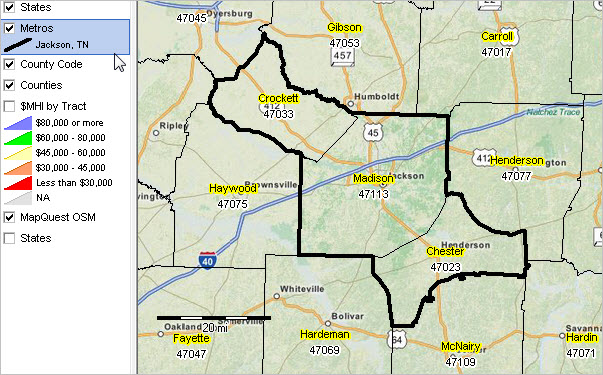

A USDA mortgage is a federal government-recognized mortgage with no advance payment criteria. The lower-appeal, fixed-rates mortgages help low- and you will modest-earnings individuals money as well as hygienic homes from inside the outlying section. For people who be considered, you need a good USDA mortgage to order single-family relations otherwise multi-family unit members property.

- You really must be a great You.S. citizen or a permanent resident that have an bad credit payday loans in Oxford eco-friendly Card.

- The property must be in an eligible rural city, for every the USDA .

- You must inhabit the house.

Old-fashioned Home loan

A conventional lender also can offer a loan that may be used to get capital attributes – multi-family unit members tools or otherwise. Nevertheless down payment standards for financing money are usually large which have a conventional mortgage.

If you are planning becoming a manager-occupant, you’ll have a tendency to run into smaller stringent mortgage approval conditions. Off payments with the holder-filled house can be as lowest as the 5% so you can ten% with old-fashioned mortgages.

Also, it is worth detailing that you might save very well attention fees if you plan and also make the leasing property your primary house. Mortgage cost can are not end up being 0.5% to 0.875% low in it circumstances compared to a residential property mortgage speed.

FHA 203k Treatment Financing

Do you want to pick a residential property that requires repairs? In this case, FHA 203k home loan insurance policies might be a helpful financing provider. Government entities-supported financial will give you the brand new ways to purchase a house and you may discusses the cost of fixes having just one mortgage.

Including traditional FHA finance, you may be able to get a predetermined-speed mortgage having a down payment only step 3.5%. But you will need live-in our home if you are planning to use this tactic getting a rental possessions pick. For example, if you would like purchase a multiple-nearest and dearest possessions and you may live in that tool when you’re renting the actual anybody else, the mortgage could work for you.

NACA Money

NACA means Community Guidelines Company away from The usa. It is an effective nonprofit program whose goal is to advertise reasonable home ownership during the metropolitan and outlying section throughout the nation.

From NACA financial system, certified individuals will enjoy pros such as for instance zero down payment costs, no closing costs, with no charges of any sort. Rates was competitive, and your credit history does not need to be best so you’re able to be considered.

You can take-out an excellent NACA loan having unmarried-family members land and you may multi-family unit members properties. However must make the domestic (or perhaps one of many devices) most of your quarters to utilize an effective NACA financial to have an investment property. Additionally must both need and you may host categories in order to meet NACA system requirements.

When you intend to inhabit the house or property which you’ll including feel leasing so you’re able to other people, you’ll be able to qualify for deposit guidance. Advance payment advice programs renders to invest in much more possible after you don’t possess a lump sum of cash stashed away.

If or not down payment guidance programs come primarily is based on the latest sort of loan you may be playing with to purchase your manager-filled local rental. Your state s to simply help the people too.

Must comment financial and you may advance payment advice apps readily available on your own condition? The newest You.S. Company out-of Construction and Urban Innovation will bring info in order to begin the newest research.