Inside the Asia, numerous creditors promote family restoration fund, for every with its unique enjoys and benefits. This article will offer an intensive review of the top 5 domestic recovery financing has the benefit of from inside the India, letting you understand the trick areas to consider when deciding on the latest best loan to your requirements.

Article on Family Restoration Funds

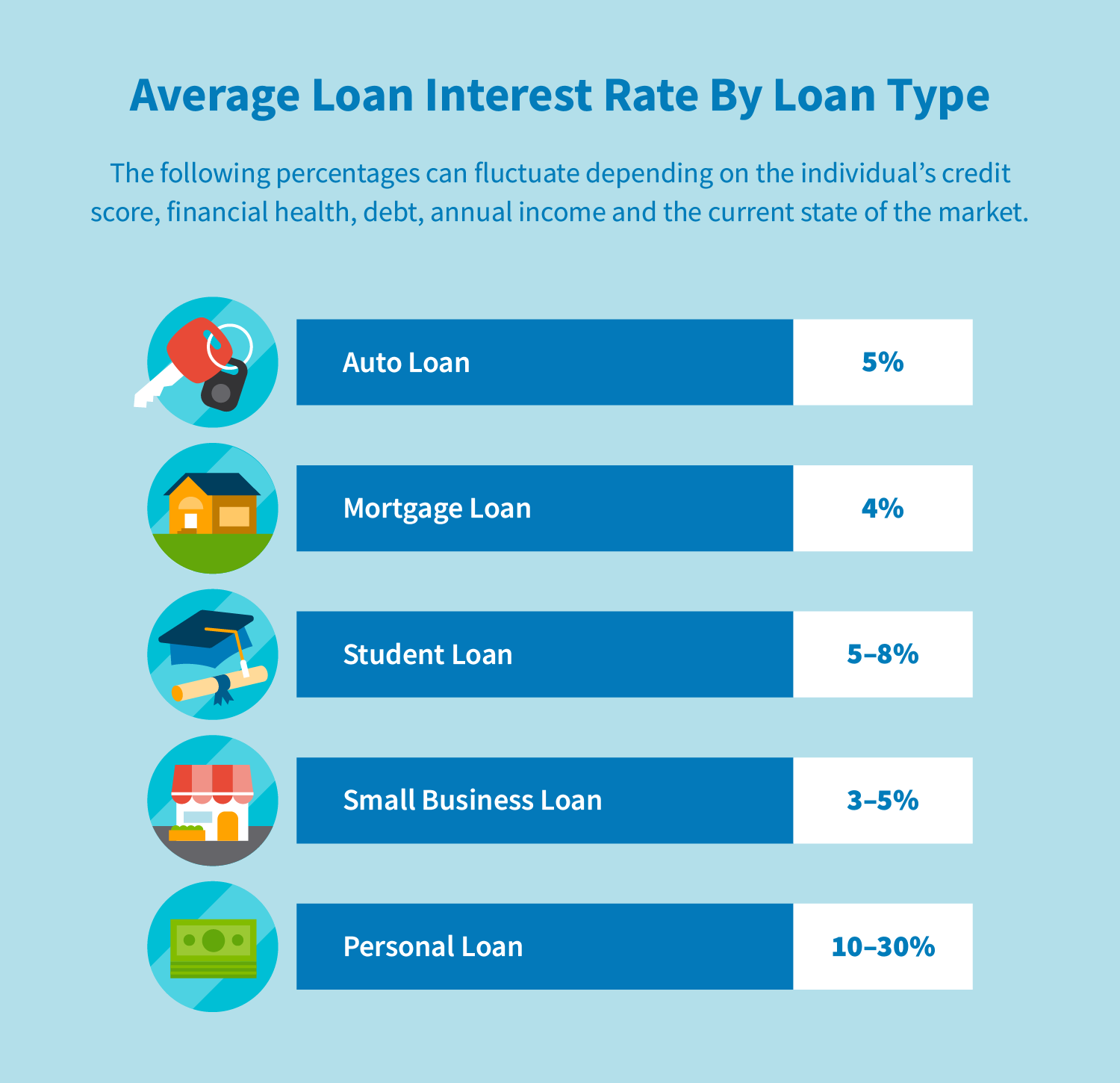

Official financial products titled domestic repair financing help people finance the do-it-yourself programs. These types of funds generally speaking incorporate down rates of interest as compared to personal money and provide easier payment conditions, causing them to a stylish option for those individuals seeking to revision their home.

Please note: The attention pricing, financing wide variety, featuring try at the mercy of transform and it is always a good tip to check on for the particular finance companies for the most most recent guidance.

HDFC Home Restoration Loan

HDFC, among India’s top creditors, also provides aggressive rates towards the household renovation fund. That have simplified files and small acceptance process, HDFC might a well-known choices one of residents trying remodel the characteristics.

New HDFC household recovery financing begins at the an interest rate regarding 6.75% yearly, it is therefore a nice-looking selection for people seeking financing the home improvement plans. The borrowed funds period normally continue as much as 15 years, delivering borrowers having big for you personally to pay the mortgage instead excessive financial filter systems.

HDFC establishes new handling commission for the house reount, that is certainly one of its secret masters. HDFC’s apparently lower percentage than the almost every other lending products regarding the sector renders its providing a great deal more pricing-effective to possess individuals.

HDFC designed its household restoration mortgage to help you serve a wide list of repair need. Whether you’re trying change your cooking area, create a supplementary space, otherwise offer all house a facelift, HDFC’s financing can provide the mandatory money.

Additionally, HDFC will not limitation the family repair financing just to architectural changes. Borrowers may also use it to own low-architectural home improvements such as painting, floors, and you can electronic work. So it self-reliance makes HDFC’s loan a flexible resource provider.

When it comes to eligibility, HDFC considers things like the borrower’s earnings, age, credit score, therefore the property’s place and value. Appointment these types of requirements makes it possible to hold the mortgage and kickstart your residence recovery endeavor.

In conclusion, payday loans Lowndesboro without checking account the fresh HDFC house repair financing try a powerful option for home owners inside the Asia. With its competitive interest levels, sensible control fees, and flexible cost terms, it offers an installment-active solution to possess funding do-it-yourself tactics.

SBI Family Repair Loan

The official Financial from Asia (SBI) has the benefit of a house renovation mortgage recognized for its lower-rates of interest and you can positive terminology. It financing is very suitable for current SBI home loan people, it is therefore an appealing choice for those seeking change the qualities.

SBI’s house recovery financing starts in the an interest rate out of six.8% per annum, among the lower in the business. So it low-rate is significantly reduce the total cost regarding borrowing from the bank, it is therefore an affordable resource solution to own residents.

The loan tenure is increase to a decade, delivering borrowers with a smooth fees months. not, it is very important note that brand new handling fee for SBI’s house restoration loan can move up to Rs. ten,000. Not surprisingly, the overall prices-possibilities of the loan remains glamorous due to the low-interest.

SBI’s home repair mortgage is made to focus on an option from recovery needs. Whether you’re planning redesign an individual place otherwise all house, SBI’s financing provide the required resource.

More over, SBI’s home recovery financing is not just limited to structural alter. It can be utilized for low-structural home improvements including color, floors, and electrical really works. This autonomy makes SBI’s mortgage a versatile financial support provider getting homeowners.