When it comes to Va loans, the house appraisal the most essential tips collectively the way to your closure. This new assessment is also determine whether the home is approved to own Va-backed financial funding.

This short article talk about the minimum property requirements getting Virtual assistant money in the Washington, in which they show up from, and just how they could apply to you when selecting a home.

A federal government-Supported Mortgage Program

Virtual assistant home loans was supported by the government, beneath the management of the latest You.S. Service off Veterans Items. The latest Virtual assistant gets lenders a partial make sure will bring more protection from monetary loss out-of borrower default.

Because of their wedding, the fresh new Company out-of Experts Facts also offers oriented particular minimum assets criteria to have Virtual assistant finance inside Arizona. These household standards are in chapter twelve away from Va Brochure 26-seven, hence functions as the state manual for lenders.

This is certainly an important design having Arizona homebuyers to learn. If a certain home does not meet WA’s minimum Va loan standards to possess safeguards otherwise architectural soundness, it may not be eligible for financial support. Owner would probably have to make specific fixes to take your house to fundamental.

According to Company regarding Pros Issues, minimal property requirements (MPRs) are designed to manage the new hobbies off Pros, loan providers, servicers, and you can Virtual assistant.

Why Take-out a good Virtual assistant Financing?

If you find yourself a recent or resigned services affiliate, there are many reasons why you should envision an effective Va-backed financial than a traditional or FHA home loan:

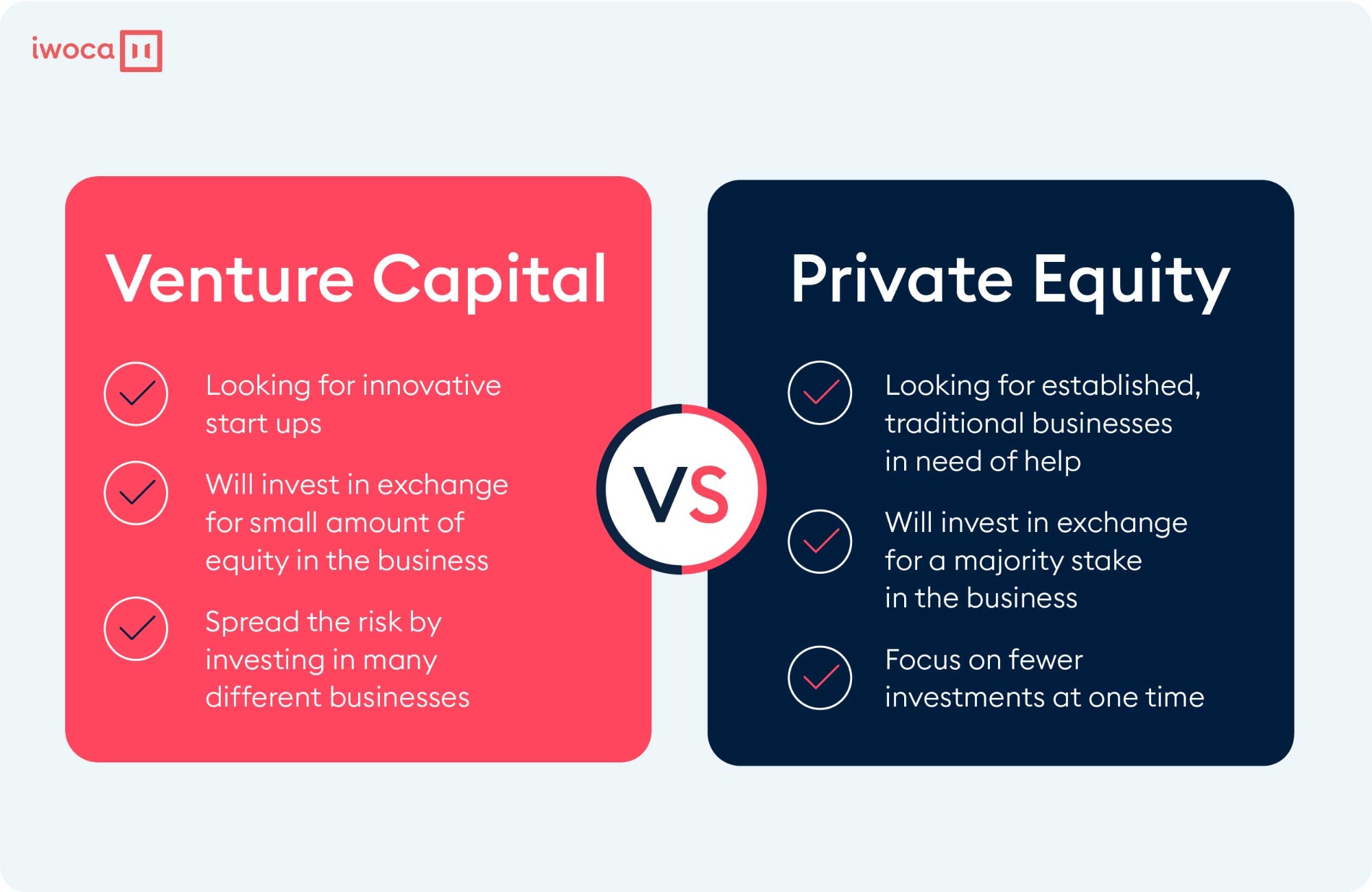

- No downpayment: You could potentially funds doing 100% of house’s price which have a good Va home loan, meaning that zero down payment try requiredpare so it so you can FHA and you may conventional finance, hence require at the very least a step 3.5% or 5% advance payment. This will translate into tens of thousands of cash might not need to come up with when buying property.

- Down payment Comparison: Clearly, new Virtual assistant loan means no deposit, while the brand new FHA and you may Conventional money wanted $17,500 and you may $25,000, respectively.

- Yearly Coupons that have Va Mortgage over 30 years: The fresh coupons is around $ a year than the FHA and you may $ per year compared to the a traditional loan.

- No Private Financial Insurance (PMI): If you apply for a conventional mortgage without at the least a 20% deposit, you should spend PMI, that may include just a few hundred cash every single monthly financial percentage. Instead, an effective Va-backed financing does not require PMI.

- Competitive prices: Usually, Virtual assistant money features lower rates compared to the almost every other home loan apps, such antique financing. Once more, this might be another essential money-saver to you.

- Versatile credit rating and you can money standards: Virtual assistant financing are simpler to be eligible for than the other financial alternatives when it comes to credit history and you may money requirements. Given that bodies is support the loan, so it also provides loan providers so much more defense should you default on the home loan repayments. Therefore, loan providers be a little more prepared to bring straight down cost. The thing you really need to envision ‘s the minimal Va financing standards.

Lowest Property Standards getting Virtual assistant Funds into the Washington

The official minimal possessions requirements getting Virtual assistant loans inside the Washington wade into the for over 50 pages. But there’s it’s not necessary for property client so you’re able to sift through all of that. Listed below are some of the biggest products included in the guide:

- Safe and Sanitary: Your house becoming purchased will likely be hygienic and you will safe. It needs to be free from shelter otherwise online payday loans Homestead health hazards that might pose a threat to your tenant.