Desire to printing Or express a custom made relationship to your debt So you’re able to Earnings (DTI) Proportion computation (along with their wide variety pre-filled)?

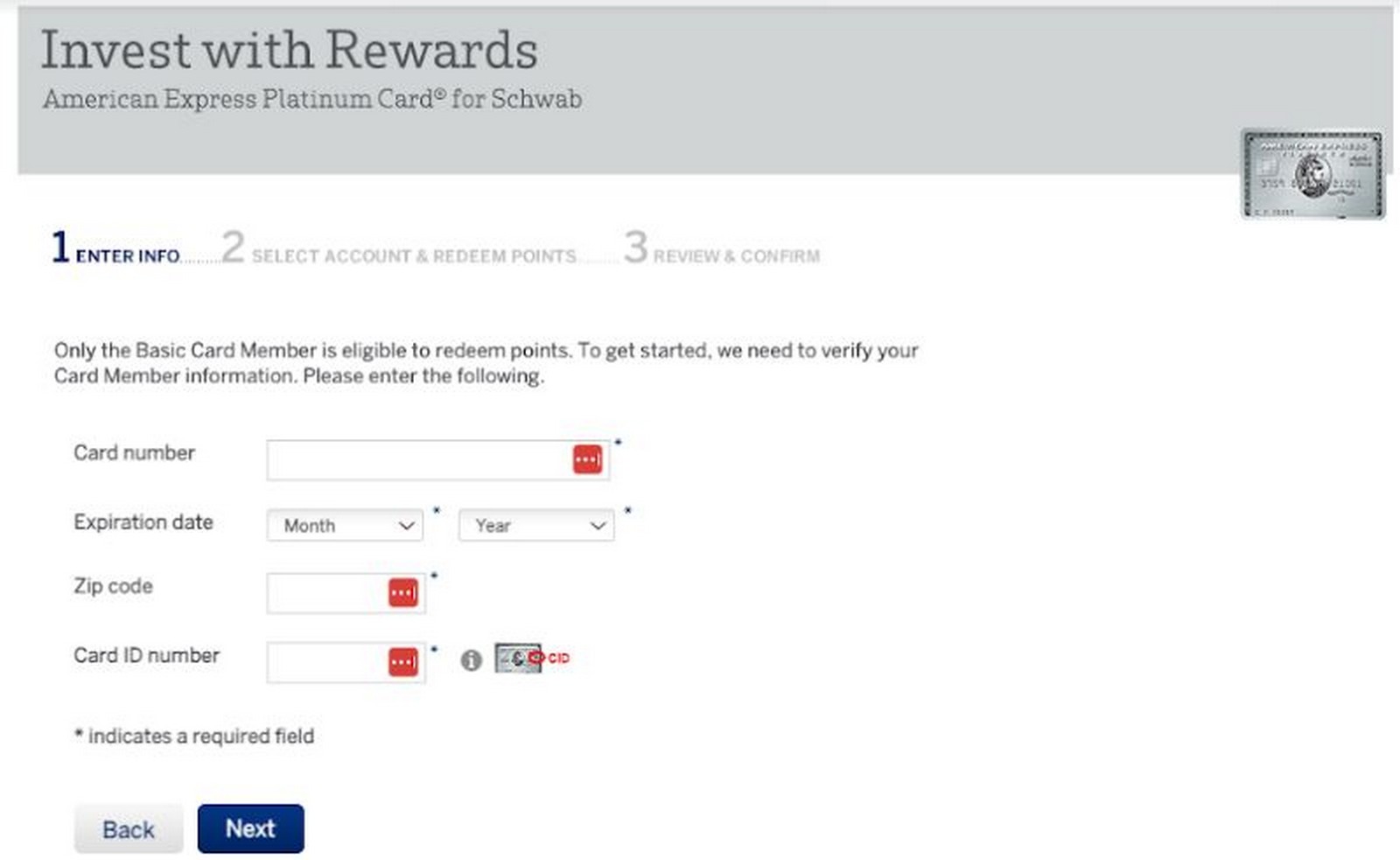

While purchasing a home and receiving a mortgage, you will likely tune in to the text debt-to-earnings percentages otherwise DTI. On the above means, after you get into the monthly money, recurring (monthly) loans and you can projected homes debts info, your debt-to-earnings (DTI) ratio calculator often assess the side-end and you will back-stop (total) proportion in order to know your finances and you will precisely guess the likelihood of providing acknowledged to have a mortgage.

The loan officials and you may underwriters are considering your own DTI to choose if you find yourself worthy of a mortgage or if perhaps you will be best off living in the parents’ basement.

What exactly is DTI?

Personal debt in order to earnings rates are just what it appear to be a proportion or comparison of your own income so you can debt. There are two main percentages a good front ratio which consists of their advised property obligations (principal, focus, taxation, insurance coverage, in addition to PMI otherwise flooding insurance, if applicable) split up by your income. The latest back or total financial obligation to income ratio was determined by the addition of the proposed housing debt for the other debt, including money to the auto loans, automobile apartments, figuratively speaking, or personal credit card debt (after which separated by your earnings).

Exactly how Was Debt-to-Money (DTI) Ratio Calculated?

Here’s how you can calculate the front DTI proportion: Estimate https://paydayloancolorado.net/leadville/ the primary and you can attract payment in your mortgage. You understand your loan count; you need mortgage and label. Once you’ve done one, you need to know (or imagine) the house or property fees and you can insurance into domestic you want to pick. If you’ve seen several home in identical town, you truly have an idea away from exactly how much property fees is. Having homeowner’s insurance rates, you could potentially estimate the new monthly costs within somewhere between $40-80. Create these items to one another therefore actually have the suggested / estimated property obligations.

Underwriters do not is other expenses associated with home ownership, such temperature, drinking water, electric, Wifi, otherwise techniques repair such as for example weed killer or painting.

Besides the facts in the list above, underwriters also include one costs you must make with the a month-to-month foundation such as for instance minimum charge card fee(s), car loan and you will education loan fee(s), alimony, youngster support, money into the an Irs taxation lien, otherwise a loan up against your 401k.

Practical money utilizes how you get reduced and you will if you is salaried otherwise thinking-operating. When you yourself have a salary from $72,000 a-year, in that case your practical income to possess reason for figuring DTI try $six,000 monthly. DTI is always calculated on a monthly basis. Now you will be ready to estimate the front proportion: separate your own suggested housing financial obligation of the $six,000 and you’ve got the front side proportion.

But learning just what earnings to utilize is a significant area out-of calculating your own DTI precisely. Here are a few prominent concerns which come up into the choosing available income.

It all depends. When you’re salaried, as in this new example above, underwriters make use of your gross income. In case you might be notice-functioning, they use their net gain shortly after expenditures.

Here’s what really underwriters create: should you get reduced a bottom paycheck in addition to extra or percentage, they bring your latest base right after which they create a-two 12 months mediocre of your own bonus or percentage when it is increasing out of one year to a higher.

Case in point: can you imagine you will be making a bottom salary off $60,000. Just last year, you have got a plus out of $15,000. The season before, their incentive are $9,000, plus income are $55,000. Simply how much income create an underwriter use to calculate their DTI?

They might take your newest feet salary out of $60,000 and split they by several to obtain $5,000 a month inside ft income. Chances are they would include a-two 12 months average of one’s incentive in case it is expanding. The extra increased in one year to another location, for them to bring a-two 12 months average. Put $nine,000 and you can $15,000 following split from the a couple to locate $several,000 for a-two year average. Monthly, this should create $step 1,000 30 days towards practical money. Their complete month-to-month earnings within this example might possibly be $6,000.

Note that we don’t bring normally your legs earnings. When you get a raise on your own paycheck, underwriters make use of the most recent salary they won’t mediocre it. How you can consider it is they average this new adjustable component of your revenue. Extra, commission, overtime. Such money commonly protected just like your paycheck is actually.

Making use of the example significantly more than, but let us opposite the latest quantity. You’ve still got an effective $60,000 ft salary however, a year ago, your own extra was $nine,000; the year ahead of, it actually was $15,000. Because your incentive is actually decreasing from year to a higher, underwriters carry out grab the newest year otherwise $nine,000. Divided by 12 mode you have got $750 thirty day period to add to your $5,000 foot earnings.

Which have care about-employed consumers, underwriters glance at its money as the varying, so they really follow an equivalent approach they use to own bonus or fee income. They just take a two seasons mediocre in case it is expanding. Self-work money, overtime while some, will often require about a two-seasons records.

They normally use their net gain immediately following expenses. There are particular factors they’re able to incorporate back including decline or single low-repeated loss.

Underwriters normally generally speaking utilize the money from your part-time jobs in case it is in identical distinctive line of performs and you may you’ve been carrying it out for around annually.

Underwriters cannot explore one earnings you never declare on the taxation statements otherwise can not file with good W2 and you will paystub.

For individuals who individual 25% or higher of your organization, mortgage underwriters will thought your mind-working and certainly will bring a-two seasons average of one’s online income in case it is broadening.

DTI Ratio Restrictions

As a whole, qualified mortgage loans limit the maximum total DTI to 43%. That means you could have only 43% of the money gonna homes or any other debt.