- Government-given private identity (license, passport, etc.)

- Public Protection count

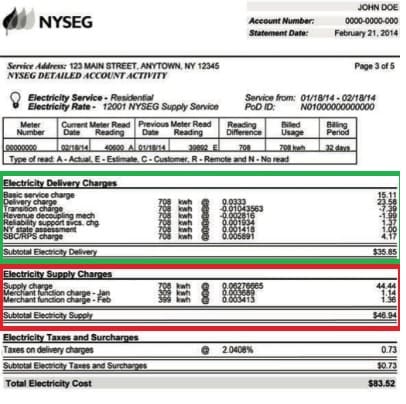

- Present spend stubs

- Two to three months regarding bank comments

- W-2s going back couple of years

- Financing account statements

- A number of their monthly expense

- Present letter if perhaps you were skilled money for the deposit

Even although you intend to manage home financing administrator in the people or higher the phone, there’s a good chance you are asked to fill in your loan application and upload your needed documentation by way of a safe on the web webpage. It expedites the program processes considerably, and it is have a tendency to easier into the loan company and also the buyer.

When your mortgage software is over, your application will relocate to this new underwriting techniques. This phase of one’s mortgage techniques will requires which have a keen underwriter yourself make certain what in your loan application, though some of your underwriting process could be automated.

When your financing get final approval and you have finished all the prerequisites and you will documents, your mortgage app can flow toward closure. The borrowed funds closure happens when you finish everything, signal the loan records, and have the keys to your property.

What’s a home loan?

Home financing is a certain kind of protected financing which is put to shop for a property otherwise a piece of home. Mortgages are given by various loan providers, including banking companies and credit unions. A few of the most well-known variety of mortgage loans become fixed-price mortgage loans, adjustable-price mortgage loans, Oklahoma direct lender installment loan and government-supported mortgage brokers instance FHA funds and you may Va funds.

Mortgages let you make use of the assets you’re to invest in since the collateral, which means that the lender you’ll claim the house otherwise make repayments since conformed. You could generally make money for approximately 3 decades prior to you possess the property outright, although lenders generally speaking allow you to pay more minimal commission amount instead of penalty if you wish to reduce your house loan reduced.

Standards getting lenders vary according to the version of mortgage together with lender your focus on. not, you can easily normally need to meet minimal credit history conditions and now have a financial obligation-to-earnings proportion one drops lower than a particular tolerance. You may need an advance payment for your home, and you should manage to establish you could repay the borrowed funds which have appropriate proof money. Depending on the number of one to advance payment, you may need to buy private mortgage insurance policies, too.

How can you Pay Your Financial?

Very home loan organizations offer multiple an approach to make an installment towards the your loan. Such as for example, Skyrocket Home loan allows you to make a loan payment online because of a secure portal, over the phone, otherwise thru regular mail. Typically, the easiest method is to set up automatic family savings distributions courtesy ACH.

What are the Fundamental Brand of Mortgages?

A portion of the style of mortgage loans are old-fashioned home loans, fixed-price and you may adjustable-price money, FHA financing, USDA financing, and you may Va fund. not, there are even recovery money, contrary mortgage loans, jumbo loans, and various formal financing circumstances.

Methodology: Exactly how we Find the Greatest Mortgage lenders

I evaluated 45 mortgage brokers and you can built-up almost step 1,five-hundred investigation situations before selecting our very own top selection. I weighed 15 criteria and provided increased weight to the people which have an even more tall impact on potential individuals.

The major selections have been selected considering products including quality of provider (weighted fifty%), working has (32%), mortgage systems (12%), and you can accessibility (6%). I grabbed under consideration extremely important factors such as for instance if the lender offers jumbo financing, just how many says the lending company is actually authorized within the, and you can exactly what the complete consumer experience feels like.