A house equity loan is a type of selection for people given an enormous renovate or some limited home improvements. Keep reading understand the way to use it.

Looking for so you can change your family because of the remodeling the kitchen, doing the fresh cellar, or using up various other types of do it yourself opportunity?

If you find yourself picking out the currency for your dreams of do it yourself normally appear challenging, you are eligible to apply for a property security mortgage to finance people methods.

Thus, how does a house equity loan work for renovations? And must you’re taking you to definitely away in place of a consumer loan and other money solution?

This web site is designed to alleviate the nightmare out-of financing your remodeling strategies being focus on the fun articles, such as discovering decorate color and filling the Pinterest forums having Doing it yourself plans. Let us dive for the outline on the a home collateral mortgage to own upgrade methods and just how this type of version of do-it-yourself financing performs.

Ought i Capture Collateral Out of My house to own Home improvements?

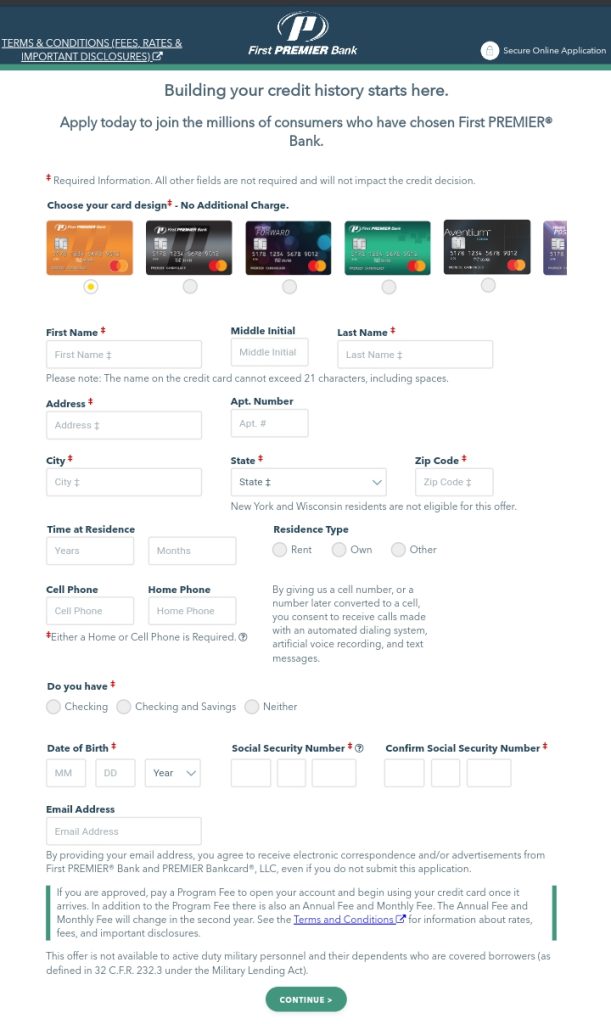

As you take a closer look at every mortgage option for financial support house renovations, you could pick delivering visit the site right here guarantee out of the where you can find assist defense the expenses.

When you compare a property improve loan vs. domestic collateral financing, property equity mortgage try financing applied for against the guarantee you have got at home. Regardless of if you might be entitled to particularly that loan relies on the level of collateral you have create.

- Household guarantee ‘s the difference in the current market value away from your property and one mortgage loans or money nonetheless owed on it. Such, if the residence is respected from the $300k and also you are obligated to pay $150k during the money, your overall collateral is $150k.

- If you’ve been making regular repayments on financial, it’s likely that you come accumulating family guarantee you have access to to possess do it yourself systems.

- Property collateral mortgage functions as one minute lien resistant to the family (and additionally your financial), so it is vital that you check out the benefits and drawbacks out of getting one away.

Why does a house Guarantee Financing Benefit Renovations?

Domestic collateral money try paid so you’re able to consumers in the way of a lump sum. You can make use of a home collateral finance calculator to get an concept of how much could discovered, however in most cases, you’ll be able to borrow doing 80% of one’s home’s worthy of. The cash may be used you would you like to. You are able to pay it off in the form of monthly installments, constantly which have fixed pricing.

If you’ve already put up guarantee, you might submit an application for that loan. Just remember that ,, as with extremely funds, you’ll need to be acknowledged predicated on other factors including credit score and you may income as well.

What is actually a restoration House Collateral Financing?

What’s a remodelling financing? A restoration domestic collateral loan is a kind of mortgage one to are used for-your guessed it-family home improvements. A predetermined-identity financing, labeled as another mortgage, is supplied to a citizen off a lender company.

Such financing may be used to defense an array of renovations such bathroom remodels, solar power setting up, driveway home replacements-take your pick. not, house equity financing can be utilized in lot of different ways given that well.

- Level medical debts

- Repaying student loans

- And also make higher purchases such as for instance a car or truck or motorboat

- Performing a corporate

- Paying off personal credit card debt

- Money a marriage

Family collateral finance normally carry a lower interest rate than individual money. The biggest chance, yet not, are a man taking up more personal debt which is protected up against its family.