In today’s very competitive real estate market, in which putting in a bid wars get an effective rite of passage a number of cities, it is easy to have people to find pushed ways over the homebuying budget.

That’s not just tiring – it does manage real dilemmas down the line once you is to help you safe home financing. The good news is, there is certainly a stride you might take to keep budget from inside the line: Score a mortgage preapproval letter early in your house research.

A home loan preapproval letter orous, but it is a file that can generally serve as the rulebook: It will reveal the dimensions of out-of that loan you might rating, and therefore leave you a roof how much you could potentially invest in the new home.

Thus before going dropping in love with highest-priced a home, grab loans in Chino Hills the procedures to help you realistically know your finances, and stick to it. Mortgage preapproval characters usually are good so that you can three months, which should leave you plenty of time to lookup inside your speed assortment.

What exactly is a home loan Preapproval Letter?

A mortgage preapproval letter try a file regarding a financial otherwise financial you to definitely states what sort of mortgage and just how far financial obligation you will be recognized to take on. Simply put, its a way of showing your entitled to new mortgage you will need to get a home.

Its a letter providing indication whether a borrower are a valid borrower to own a home loan, claims Kevin Parker, vice-president of occupation mortgage originations during the Navy Government Credit Union.

A mortgage preapproval is essential for a few other factors, Parker states. Possibly vital in today’s aggressive marketplace is one to a beneficial preapproval page tells owner of property that you are a serious visitors who’ll afford to spend what you are providing.

Specialist Idea

Home loan preapproval letters be than simply an article of papers: They can even be your own roadmap for how much you might purchase, and you can what kinds of house you really need to manage.

And additionally, nowadays, which have a preapproval page is far more-or-quicker a requirement when you need to realize a house with an agent.

This is simply a method for everybody to use the go out intelligently, states Katie Bossler, a quality warranty pro during the GreenPath Financial Health. Real estate agents don’t want to spend the go out showing your house you can not become approved getting.

The latest preapproval page can also help direct you just like the a purchaser: It simply supplies the bank a way to allow the borrower know very well what their potential [loan] solutions was, Parker claims. One generally speaking decides the kinds of house they must be looking for.

That ily land rather than condos, which have other loan criteria; the brand new preapproval page serves just like a map to your home options.

Just how long Does it Sample Get Preapproved getting home financing?

The newest schedule having protecting their preapproval page utilizes the financial institution and on how you submit an application for one to. Bossler claims it will take a couple of days in most conditions.

Nearly all lenders, large and small, now render on the web preapproval applications, which speed up the method and permit you to submit documents (such proof of earnings) online. To get more challenging applications – while you are thinking-operating, eg – extra documentation you are going to reduce probably the on the web processes.

If you need to satisfy with a loan provider and apply from inside the individual, that is always a choice, too. This really is most of the personal preference, Parker says.

Bossler claims it’s also wise to make sure to understand the distinction anywhere between a beneficial preapproval and a beneficial prequalification. Specific lenders offer instantaneous approval getting an effective prequalification page, that is from oneself-advertised income investigation and you can cannot bring an entire lbs out-of a great proper preapproval page, hence demands so much more paperwork.

The length of time Are a beneficial Preapproval Good for?

Why you to preapprovals end is really because your financial situation will get changes somewhat over the years, which in turn affects what type of mortgage it is possible to be eligible for. Loan providers want to make yes they are providing you with an exact loan guess one reflects their most up to date financial reputation.

We could usually return and you will revitalize them, Parker states. Usually this should be done for the fresh new build residential property, if houses was complete weeks after the initially preapproval is offered.

This product plus professionals you because customer – you ought not risk be to present an inaccurate bring towards an excellent family to discover later so long as be eligible for that home loan.

Preapproval emails is also refreshed according to the house you might be trying to pick. Such as for instance, if you be eligible for a maximum $eight hundred,100 home loan, nevertheless the home we want to purchase try detailed to possess $three hundred,one hundred thousand, you do not need to let you know all of your notes of the distribution an excellent $400,100000 home loan preapproval, Parker says. When it comes to those things, characters would be customized, to an extent, to match this offer you will be making.

Do i need to Attract more Than One Preapproval Letter?

For each lender can get a different sort of approach, and differing rates. As well as, we need to be sure to feel comfortable with this certain mortgage administrator.

However, that doesn’t mean your necessarily must look for good preapproval letter per bank you speak with. For every single financial inquiry you complete does adversely perception your credit rating, usually from the a number of factors. For those who submit numerous issues within an excellent forty five-go out window, although not, you might be able to prevent multiple moves to your borrowing, due to the fact credit bureaus may find definitely youre mortgage looking.

Please talk about your options and possess multiple designed financing estimate for the certain situation. But just remember that , there can be a pile regarding documents necessary for for every single preapproval, and you also wish to be conscious of impacting your credit rating.

Whenever Is a great Time for you Initiate the loan Preapproval Techniques?

Parker states there clearly was a common prevent certainly realtors the guy works with: Definitely possess good preapproval page one which just lay good client in your auto. That is because realtors should make yes you might be major and you will licensed for a financial loan before you could pick one homes – and you may possibly fall for him or her.

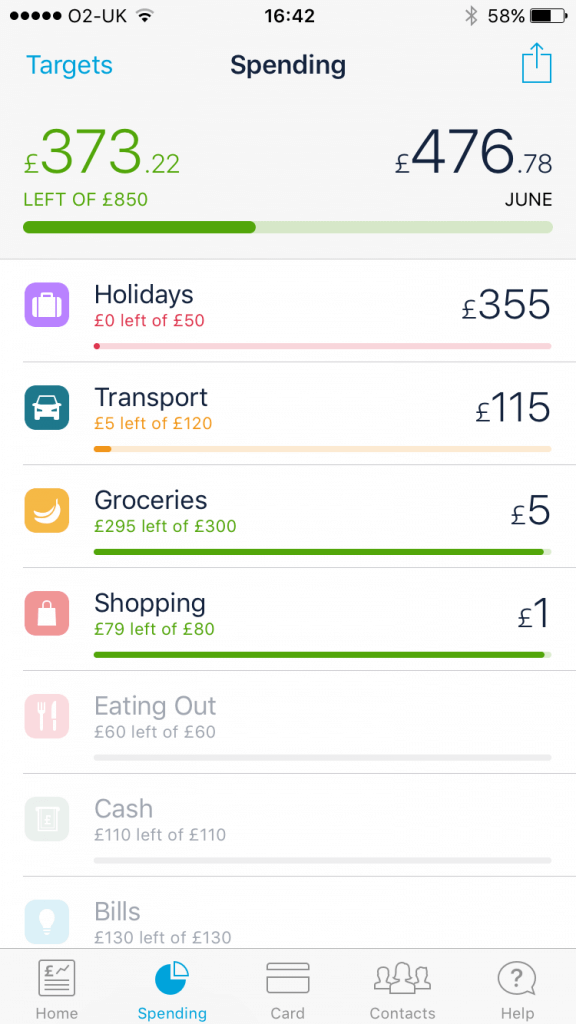

This new preapproval is additionally vital that you safer very early as a way out-of choosing their homebuying budget. If you know exactly how much away from financing it is possible to qualify for early in your property research, you might work with characteristics you to slide within that budget.

The sole downside from starting the procedure too quickly would-be whether your finances change notably through your family research – if you take out an alternate auto loan, such as for instance – plus it has an effect on the kind of loan you qualify for, Parker claims.

But carrying out too late also can cause problems. For individuals who hold back until you might be prepared to build a deal, discover oneself scrambling to contact a lender, and could skip your opportunity to get a bid to your household.

So as in the near future as you have their ducks consecutively – definition you realize your credit score are strong, you really have adequate money and you may a support off coupons – feel free to observe how much family you can extremely search for through getting a proper preapproval.