Mortgage notes enjoys various other terms and conditions. The difficult money mention gets a shorter months, normally below per year. Along with, with respect to the package, the newest debtor can work away an arrangement not to ever generate unexpected desire money and just pay back the interest towards prominent at the conclusion of the expression.

Benefits of Difficult Money Financing

They work better as they are a great way from preventing the stringent recognition means of almost every other mortgage sizes. Some of the benefits associated with hard money finance was

Supply

Extremely financing establishments that offer antique loans otherwise a timeless financial cannot offer a challenging money mortgage. not, into the low-yield off fixed-income investment, many people are quite ready to bring one. He could be relatively easy to locate and you can a somewhat preferred mode out of capital for the majority of https://paydayloanalabama.com/coffee-springs/ a house dealers.

No Credit rating

The fresh borrower’s creditworthiness isnt sensed part of a difficult money mortgage. It means that you can get a difficult currency mortgage established solely to your value of your residence, maybe not your credit score. It can also help to explain why he or she is popular certainly a home people, actually anyone who has generally struggled to view financing before.

Rates

Compared to the old-fashioned loans otherwise conventional financing, difficult currency fund started prompt. Antique loans usually takes a couple months, in the event one thing wade well. Tough money money is deposited from inside the a good borrower’s family savings within a few days. Extremely loan providers can get it so you can a debtor within a week. It gives a sizeable advantage on a conventional loan or antique financial support.

Large LTV

Brand new readily available amount borrowed often is as high as the house well worth. They implies that you need to use the full worth of an investment property plus don’t you would like a higher advance payment to help you contain the possessions. It can make this type of finance quite popular having home flippers and you will rich people alike.

Commission Liberty

Of several tough currency fund provides extremely flexible payment solutions. Particularly, you happen to be capable of making attract-merely money for the majority months. If you don’t framework the hard money financing so that you back the principal and you may focus at the bottom. Naturally, so it entails that you’ll be purchasing alot more out of in the course of time.

Package Validation

Hard currency lenders are very well versed into the evaluating rental property revenue as they money a number of other dealers and can acknowledge a successful package from a great money-gap. When the numerous tough money lenders will not fund their contract, it is time to be cautious because experienced buyers acceptance prospective risks.

Disadvantages out-of Tough Currency Fund

There are some real estate investment dangers therefore one should has actually the ideal exposure mitigation bundle in position. Despite most of the professionals below are a few of high potential complications with difficult currency fund.

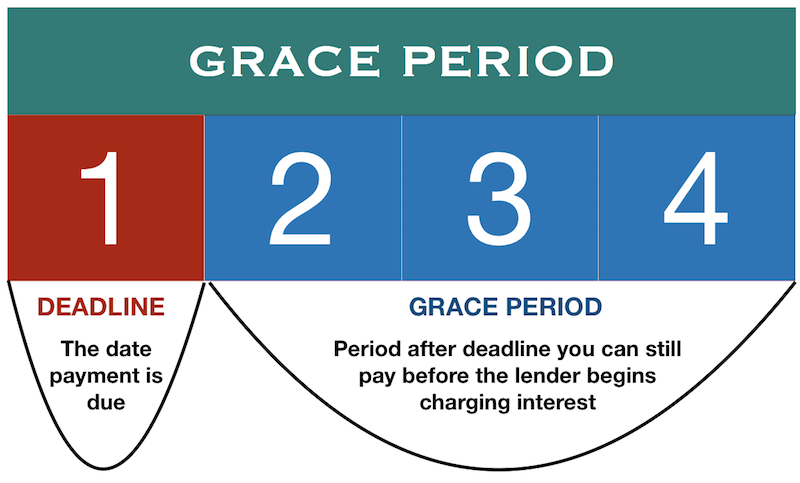

Quick payment episodes

You will commit to it ahead of time, but the majority hard money fund do not have a lot of time shell out periods. You will be likely to pay back the bucks you acquire as quickly as six months otherwise several years. It teaches you why tough money funds usually are utilized for brief attacks up to more steady and you may sensible financing comes in.

Higher interest

Hard currency financing have a lot higher rates of interest. The bottom interest levels range higher than many other different funding typically found in corporate finance finance for example Government Construction Management (FHA) financing, Virtual assistant money. You might also need products energized, improving the full tough currency mortgage costs to higher than simply one provided by traditional lenders. Additionally, you still feel the usual suite of costs you have to pay, plus origination costs. It results from a challenging money financing are considering a good tangible investment.