What you need to Discover

- In advance of a property customer actively seeks a mortgage lender, they’ll need certainly to evaluate their credit rating, introduce a budget, and you may save yourself to possess a down-payment.

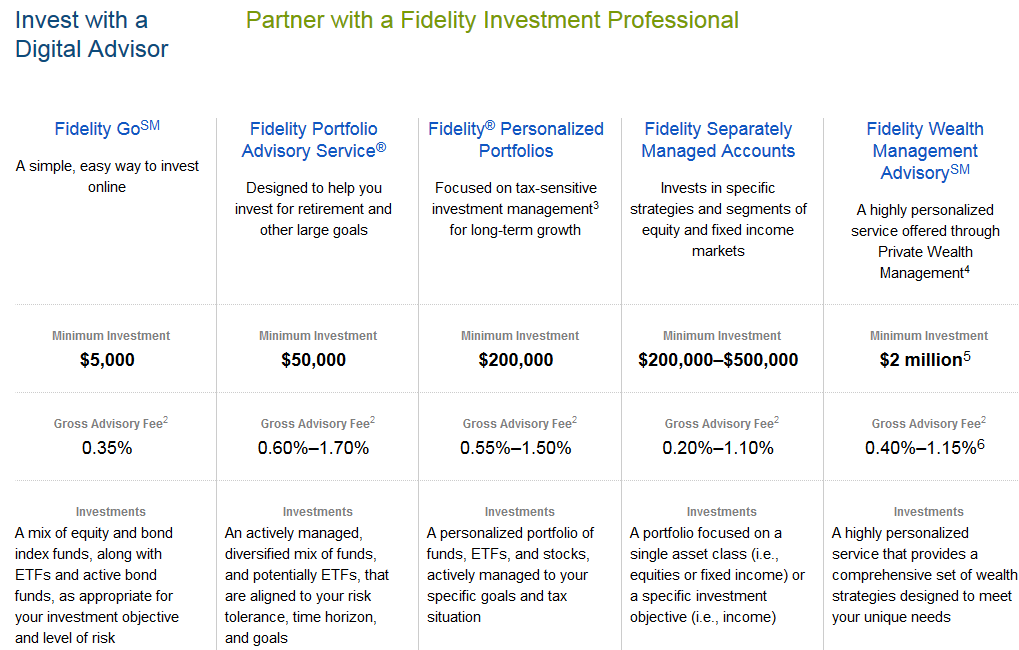

- Consumers would want to acquaint themselves to your different kinds of mortgage brokers readily available before choosing a loan provider.

- Once the borrower knows what type of mortgage needed, they can check around to own quotes and you can contrast financing conditions and you can rates.

- Individuals will want to get preapproved with quite a few various other loan providers ahead of selecting the the one that works well with them.

A house is one of the most tall requests a lot of people make in their lifetime, and some should take out a mortgage getting able to afford a home. A mortgage is a kind of financial giving upcoming homeowners with the currency they need to buy property. They’ll after that spend that money of within the monthly obligations up to the borrowed funds is located at the termination of the title. Just like the mortgages is actually enough time-identity finance, it pays to help you package ahead and discover and you will qualify for the ideal loan. More often than not, consumers inquire how to pick a home loan company when there will be unnecessary you should make sure. By using such strategies, individuals is also make certain he has got done their homework in finding a knowledgeable lenders. After that they are in a position to move on due to their home pick that have peace of mind.

1: Check your credit history or take procedures to evolve the borrowing rating, if required.

In advance of a home visitors starts talking to the big mortgage brokers, might should acquaint on their own employing latest credit score. To do this, the fresh borrower may wish to access the credit history out of all the about three credit bureaus (Equifax, Experian, and you will TransUnion). There are numerous a way to do that, however, home buyers can also be end scams of the supposed right to the brand new Government Trading Commission’s site and you will being able to access a free of charge credit history just after a year. Homebuyers would want to look at their credit reports having problems and make sure that every the percentage records is correct. In the event the client notices one errors, they are able to attention or inquire about alterations. Because this process takes go out, however, home buyers may wish to do this at the beginning of the method.

Consumers also have to consider their FICO credit rating, for the reason that it matter should determine the many sorts of lenders they could be eligible for and their estimated interest rate. A credit score informs mortgage lenders how trustworthy the brand new debtor happens when it comes to paying down its personal debt. One of the best indicates having borrowers to improve the borrowing rating and show they are economically legitimate is to shell out their expense timely. Individuals can also run settling financial obligation before applying getting a home loan. It is best to apply for borrowing stability off so you can only about 20 to 30 % regarding a borrower’s readily available loans Heritage Village CT credit limit. Particularly, a borrower having all in all, $ten,000 for the available credit would like to keeps a balance out-of no more than $dos,000 to $step three,000 to their credit cards. This shows loan providers that borrower was responsible making use of their readily available credit, causing them to prone to shell out its monthly mortgage statement promptly. One, therefore, can cause the newest debtor being qualified for a lower mortgage price.

Once a purchaser understands the credit score, they will certainly need to dictate a resources for their household get and you can begin protecting getting a downpayment. The cost of the house get is just one little bit of new puzzle; homebuyers will be interested in the price of resources and you will budget for assets fees and you can homeowners insurance. Home buyers who can establish a chunk of money when purchasing a house can undertake smaller obligations as opposed to those that simply don’t possess a down-payment. Consumers exactly who establish less than 20% of your own buy rates towards a conventional home loan will normally be asked to pay private financial insurance rates, otherwise PMI, up to it started to one 20 percent security draw. It is because lenders see customers with a larger down-payment once the safer than those which have a small (or no) down payment.