The effects to borrowers exactly who rating ensnared with the help of our loan providers is become serious. It easily find by themselves in times where he’s incapable to repay the loan when the substantial balloon payment will come owed. That it invariably contributes to property foreclosure and the death of their residence. Sometimes, such hard currency loan providers are incredibly and make an excellent loan-to-own toward intent that borrower gets zero choice but so you’re able to standard, and also the financial can only just foreclose or take control of one’s house with a good number of collateral kept for them.

Schemes so you can Evade what the law states

The latest systems these lenders use to avoid consumer safeguards statutes was multiple. Really play with falsehoods such as for example stating the newest borrower’s home is in fact accommodations or your borrower is utilizing the cash to possess a business in place of to cure the fresh new default and prevent an effective foreclosure. Within these circumstances, the lending company requires the homeowner in order to sign data and this falsely claim your mortgage is for a business and for a vacant house. Desperate homeowners against foreclosure commit to register buy to keep their house.

The fresh ruse isn’t very difficult to see, the expansion of phantom business loans continues once the administration and you can punishment is difficult to get having a citizen inside the economic distress. They can’t manage to hire an attorney while the matter was also tricky for an expert bono legal counsel clinic to manage. There’s absolutely nothing recourse in their mind, even when these bad guys is actually trapped. And also whenever judge cases is actually produced from the bank, the debtor is actually obligated to pay back certain amounts of the latest financing that were useful the borrower’s work for.

Many times, such progressive point in time bootleggers and you can moonshiners threaten the resident it victimized having stop lawsuits when they talk upwards. The fresh new perpetrators claim that the fresh borrower enough time swindle once they signed the newest company purpose statement when, in fact, the borrowed funds representative and you can lender educated them to take action. What is significantly more egregious is the fact such home loans has actually a fiduciary responsibility toward borrower that is entirely forgotten because the broker is targeted only towards protecting the new commission.

Homeowners Be mindful

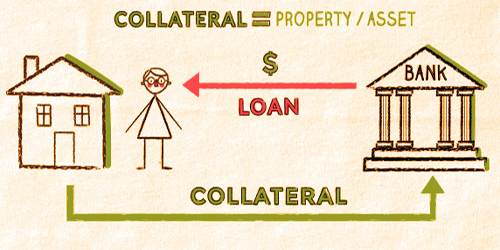

Unethical personal tough-currency loan providers have to give you items that are not only too good to be true however they are tailored especially when deciding to take advantage of people who possess lack options. Their goal should be to orchestrate a loans capture, foreclosing on home and you may pocketing a big earnings once they sell it. When you’re hard-currency mortgages seems like a good idea getting consumers which features less than perfect credit otherwise that do maybe not qualify for old-fashioned mortgage loans, they may be very high-risk and you can generally break multiple government lending rules. Borrowers that offered a painful-money financial should be aware of the risks and ought to meticulously feedback all the small print of your loan before agreeing so you can they. In addition, if the a borrower believes one to the tough-money mortgage has actually violated people government financing rules, they have to look for legal advice and you can file a complaint for the CFPB.

Like the bootleggers from dated, such unethical schemers will ultimately getting stuck and you can can’t get loans for law school penalized because of their illegal issues and you can gangster-such ideas. Experienced people are all the more assaulting right back because of the reporting these to bodies government and you will filing match against them into the state and federal courts.

Assistance is Available

If you were victimized because of the a difficult loan provider, there’s help readily available. From the working with oriented and you will legitimate companies for example Attorneys Realty Class, home owners can protect by themselves out of con and get the loan recovery they need.