Therefore, their accounting cycles are tied to reporting requirement dates. The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements. Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors. In earlier times, these steps were followed manually and sequentially by an accountant.

Prepare Financial Statements

Together, they provide insight into a business’s financial position, results of operations, and cash flow. It’s time to go through the various transactions the business saw over the past quarter, including sales and expenses, like supplies and delivery costs. Ray reviews his sales journal, bank account statements, and credit card statements for the quarter, checking each transaction and confirming its accuracy.

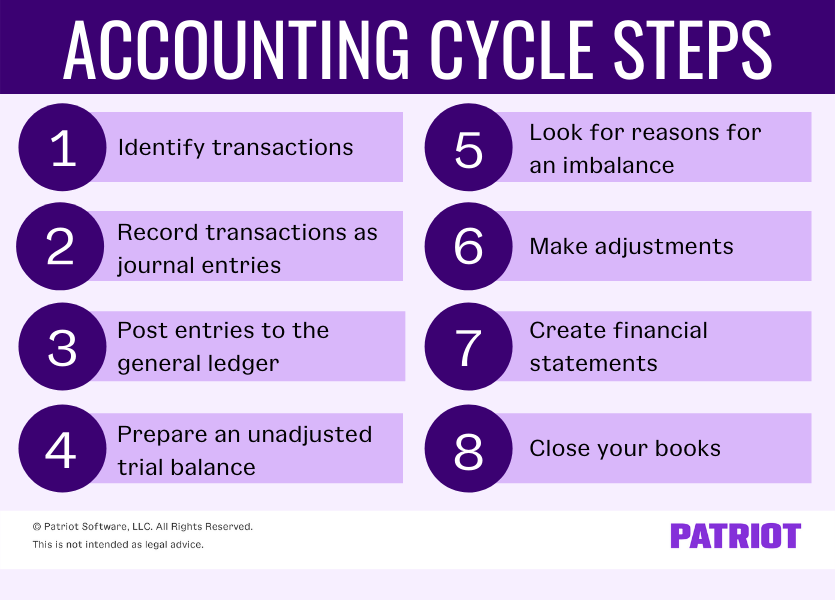

The 8 Steps in the Accounting Cycle A Step-by-Step Example Guide

You can then use your time and resources to make strategic decisions with the information you’ve gathered from these key reports. Ultimately, understanding and executing the accounting cycle properly empowers you to steer your business toward greater financial stability. These are not the only financial statements that can be generated, but they are the most important.

Post to the Ledger

The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. We recommend reading our article on this subject so that you can choose the approach that makes the most sense for your business.

A purchase order (PO), on the other hand, is an agreement to buy goods or services, specifying details such as the quantity and price. It is typically used by the purchasing department to confirm orders with an external party. The need for this Sector Guidance is due to the specific nature of ICT products. This makes it inherently challenging to execute a detailed life cycle assessment (LCA) for typical ICT equipment. Recording documents essential information from the transaction, such as the transaction date, amount, customer name, and other information the business needs. Continuous professional development is vital in keeping accounting staff updated with the latest accounting standards, technologies, and best practices.

Shifting to Accrual Accounting: How Small E-commerce Businesses Can Streamline Bookkeeping Across Multiple Platforms

In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research.

Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. From the meticulous input of financial data to the generation of reports, the accounting cycle ensures a systematic approach to maintaining financial records. The process nonetheless does not end with the presentation of financial statements. Subsequent steps are necessary to prepare the accounts for the next accounting period (steps 8-9). The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication of financial information.

These journal entries have to be made in reference to the original transactions. They shouldn’t be done in bulk, and any adjusting entry needs an original transaction for reference. Accounting is made up of quickbooks vs xero all of the ways that a business’s money moves. It documents every transaction, making sure that things are accurate and kept track of. Without accounting, most businesses would be in poor financial health.

Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. Moreover, if you have inaccurate information, you might inadvertently mislead your lenders, creditors and investors, which can have serious legal consequences. Finally, if your books are disorganized, you might provide inaccurate information when filing taxes. Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone. The finance department then prepares the cheque for payment to suppliers which is needed to be approved by the authorized signatory.

- During the month of January, Haram’s Company process the following transactions.

- These financial statements are the most significant outcome of the accounting cycle and are crucial for anybody interested in comparing your business’s performance with others.

- Public entities need to comply with regulations and submit financial statements before specified deadlines.

- Interpreting financial statements helps you stay on top of your company’s finances and devise growth strategies.

- Creating an accounting process may require a significant time investment.

Next, you’ll break down (or analyze) the purpose of each transaction. He’s a co-founder of Best Writing, an all-in-one platform connecting writers with businesses. He has built multiple online businesses and helps startups and enterprises scale their content marketing operations.