You have made the newest courageous choice to find an alternative household and you’re today desperate to wade household-google search. However, before you begin scheduling showings and you may looking at local postings, it is essential to understand how to get financing in Maryland.

1. Look at your Credit rating

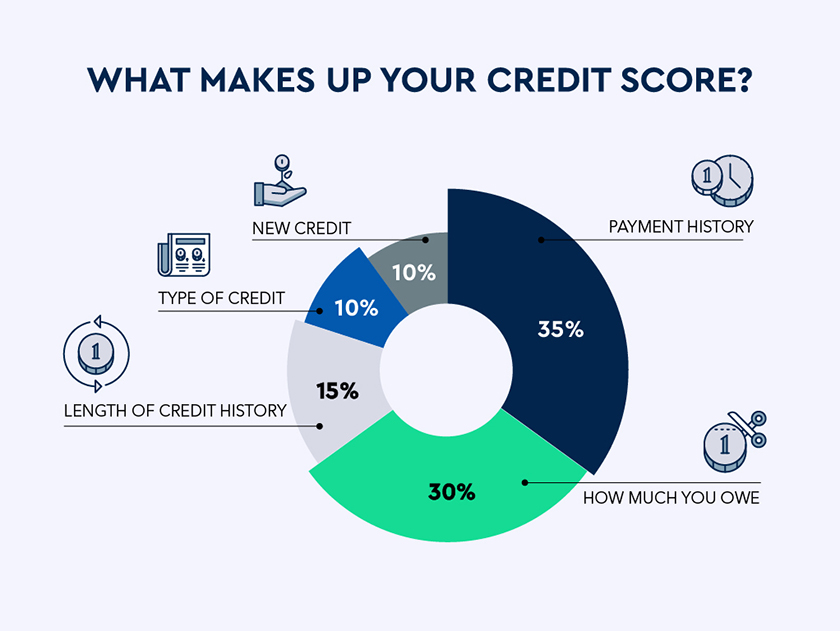

It is essential to have a good idea of just how debt situation does updates your throughout the eyes ones handing out mortgages prior to actually ever handling one lender. Very, look at your credit score observe where you’re now.

You are permitted a free annual credit file out of TransUnion, Experian, and you may Equifax, which are the step three biggest credit rating bureaus regarding the U.S. In the event your score was over 720, you could be eligible for various mortgages and you will very good focus pricing.

Once you understand your credit rating ahead will allow you to best get ready for new numbers, form of funds, therefore the interest levels that one can assume loan providers to offer your.

2. Gather the necessary Documents

You happen to be necessary to give a lot of financial information once you make an application for your loan whether or not you are utilizing a cards relationship, antique bank, or other lending company. Some of the trick records you should have are:

- W-2 Versions

- Tax statements

- Societal Coverage Count

- Pictures ID

- Resource Statements

- Savings account Statements

- Pay Stubs

- Most other Mortgage Statements

Every documentation significantly more than will be given for the lender throughout the pre-acceptance that will should be up-to-date inside the last mortgage approval; techniques.

step three. Pre-Degree

Taking pre-licensed is the initial step pop over to these guys regarding mortgaging procedure. It generally does not actually wanted rigid proof earnings, it is a great first rung on the ladder when looking for a house to find.

Pre-qualification relates to taking interviewed because of the bank regarding the earnings, expenses, and assets. Whilst it isn’t necessarily an official techniques and won’t actually imply even when you might be approved on financing when it comes time, it can help you have made a better concept of the amount out of mortgage you really can afford given that day arrives.

All the information achieved throughout the pre-qualification will help assist you in properties in your price range and you may narrow your search, ultimately causing a faster and less frustrating process to you.

cuatro. Pre-Recognition

Mortgage pre-recognition ‘s the latest step before finally getting financing during the Maryland. Although it actually a compulsory a portion of the techniques, pre-approval may help place both your face and therefore of one’s seller relaxed.

In order to safe pre-recognition, you may be required to render all of that essential papers particularly since the distinguishing suggestions, evidence of assets, and you can proof money to the bank. The lending company will then pull your credit score and make use of all new readily available guidance to choose whether or not your meet the requirements, how much cash out of that loan you actually qualify for, and at what interest rate.

Thereupon guidance available, you could potentially more with confidence put a substantial bring down on their common assets, getting a step closer to circulate-within the go out.

5. Protecting Partnership

Once you’ve financial pre-approval as well as have a recommended provide with the a home, the financial institution commonly assess the property value the house or property which you propose to pick.

With all one to suggestions at hand, the lender will question a formal commitment to lend your a particular sum of money in the a certain interest. New determination generally speaking comes in step one from cuatro forms:

- Approved

The chances of getting a denied otherwise Frozen was far lower for those who have pre-approval. Once you discovered that it acceptance, you’re well on the way to last closure time plus brand new property.

Delivering financing into the Maryland will be stressful, but with the help of top, knowledgeable agents, the complete procedure might be smoother. Allow us to lover with you finding your dream assets. Contact us during the 800-599-1563 now!