This method is suitable for industries that manufacture fertilizers, chemicals, textiles, processing and bottling of mineral water etc. It refers to the ascertainment and use of standard costs and the measurement and analysis of variances. Standard cost is a predetermined cost which is computed in advance of production on the basis of a specification of all factors affecting costs. To find out variances, the standard costs are compared with actual costs. Where a business does not produce tangible goods but renders some service, the system of costing would be known as operating costing. This is used to determine the costs of services rendered by airways, railways, roadways, hospitals, power houses etc.

What is your current financial priority?

- When goods are sold that include numerous other processed parts, and these parts are priced differently, multiple costing, often referred to as composite costing, is a sort of accounting method employed.

- Contract costing method of another specific order costing which is not much different than the job costing method.

- Absorption costing is a cost accounting method that includes variable costs (such as direct materials and direct labor) and fixed overhead costs in calculating product costs.

Since the unit of production may remain incomplete at different stages of production, cost of the finished units as well as work-in-progress is computed at the end of the period. The finished product of one process becomes break even point calculator bep calculator online the starting material for the subsequent process. While transferring output from one process to another, costs are transferred as well. Normal losses are carefully predetermined and abnormal losses segregated.

Module 2: Cost-Volume-Profit Analysis

Marginal costing can help management identify the impact of varying levels of costs and volume on operating profit. This type of analysis can be used by management to gain insight into potentially profitable new products, sales prices to establish for existing products, and the impact of marketing campaigns. Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing all of its variable and fixed costs. This type of method of costing is suitable for organizations that make products in mass production via continuous operations. Costing methods that only consider direct or indirect costs, but not both, will not be appropriate for reporting inventory costs as part of your tax obligations. However, they can be very useful for identifying which systems, materials, processes, and overheads impact profitability – and how.

Costing Methods: A Complete Guide

All indirect expenses incurred in operating a firm, such as rent, utilities, and insurance, are referred to as overheads. Since they are not directly related to the creation of goods, overheads are considered indirect expenses. A costing method is a way for figuring out how much something will cost.

What Is the Importance of the Costing Method?

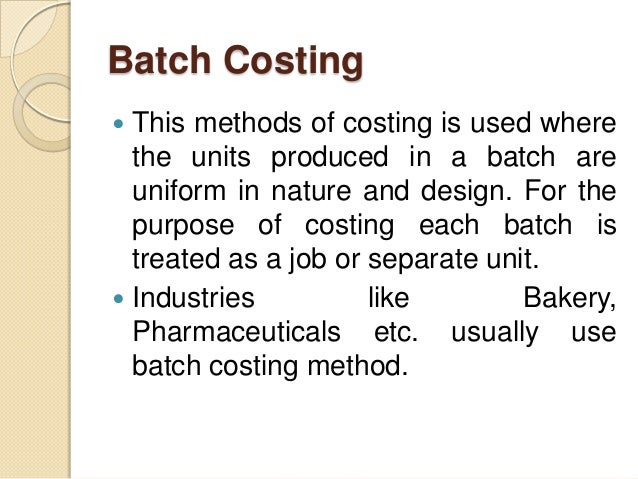

Here costs are booked against a batch order number and total costs are divided by total quantity in a batch to get the unit cost of each job. The practice of charging all costs, both variable and fixed, to operations, products or processes is termed as absorption costing. Differential cost is the difference in total cost between alternatives evaluated to assist decision making. This technique draws the curtain between variable costs and fixed costs.

These activities are also considered to be cost drivers, and they are the measures used as the basis for allocating overhead costs. Activity-based costing (ABC) is a cost accounting method that assigns overhead costs to products based on the activities that are required to produce them. This method considers the different activities involved in producing a product and the resources required for each activity.

It is, therefore, necessary to ascertain the costs for each job separately. This method of costing is applicable where the work consists of specific orders or Jobs batches or contracts. Job costing, Batch costing and Contract costing come under this category.

Manufacturers must set “standard” rates for labor and materials utilized in production and/or inventory costing. All of the direct and indirect costs firms incur when producing a good or rendering a service are referred to as production costs. In contrast to general accounting or financial accounting, cost accounting is an internally focused, firm-specific method used to implement cost controls.

Products you believe are winners can often contain hidden costs that are eating away at profit. Similarly, products that appear to sell poorly may generate higher profits due to lower job costs. Job costing mitigates the risk of grouping big variations, which can hide some of your potential wins and losses.

Job costing and contract costing are the same in terms of their underlying principles. Job costing and contract costing are also frequently referred to as terminal costing. Each of these methods applies to different production and decision environments keeping in mind the entire production and distribution unit.

When choosing the best costing method, take your business’ size into consideration. If you have a smaller business with limited resources and a straightforward production process, you may benefit from simpler costing methods like job costing or standard costing. However, if you run a large enterprise with multiple product lines, you may need to implement a more detailed method like activity-based costing (ABC). Be realistic with your accounting team’s capability, and be sure to find software that will support them. Actual costing is a method where the cost that you assign to a product is based on the actual expenses that your business incurred during its production. A furniture manufacturer would likely use the actual costs of wood, labor, and factory utilities to calculate the cost of each piece of furniture.