A reserve for doubtful debts can not only help offset the loss you incur from bad debts, but it also can give you valuable insight over time. For example, your ADA could show you how effectively your company is managing credit it extends to customers. It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to). That percentage can now be applied to the current accounting period’s total sales, to get a allowance for doubtful accounts figure. The amount is reflected on a company’s balance sheet as “Allowance For Doubtful Accounts”, in the assets section, directly below the “Accounts Receivable” line item.

Order to Cash

There are various methods to determine allowance for doubtful accounts, each offering unique insights into the potential risks your accounts receivable might carry. Here’s a breakdown of the two primary methods and some additional strategies used by businesses for ADA formula and calculation. No matter how careful you are while evaluating your customer creditworthiness, offering trade credits increases your risk of bad debts, as some buyers will inevitably be unable to pay. At Allianz Trade, we can help by providing you with trade credit insurance services and tools needed to reduce the uncertainty of buyer default and greatly reduce the impact of bad debt. It can also help you to estimate your allowance for doubtful accounts more accurately.

- While this method can be time-consuming, it offers a highly accurate estimate of doubtful accounts, particularly for businesses with a smaller number of high-value receivables.

- With this method, accounts receivable is organized into categories by length of time outstanding, and an uncollectible percentage is assigned to each category.

- The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account.

- The accounts receivable aging method uses accounts receivable aging reports to keep track of past due invoices.

- Then, the adjusting entry to bad debt expense and the increase to the allowance account is an additional $1 million.

Real-time credit health with AI-based credit scoring models

Ideally, you’d want 100% of your invoices paid, but unfortunately, it doesn’t always work out that way. According to recent research by Dun & Bradstreet, publishing, commercial printing, and prepackaged software providers are among the industries is allowance for doubtful accounts a permanent account most likely to report uncollectible invoices. Allowance for Bad Debts (also often called Allowance for Doubtful Accounts) represents the estimated portion of the Accounts Receivable that the company will not be able to collect.

Methods for Estimating Doubtful Accounts

That journal entry assumed a zero balance in Allowance for Doubtful Accounts from the prior period. This journal entry takes into account a debit balance of $20,000 and adds the prior period’s balance to the estimated balance of $58,097 in the current period. The risk classification method involves assigning a risk score or risk category to each customer based on criteria—such as payment history, credit score, and industry. The company then uses the historical percentage of uncollectible accounts for each risk category to estimate the allowance for doubtful accounts. Let’s say your business brought in $60,000 worth of sales during the accounting period.

Streamline your accounting and save time

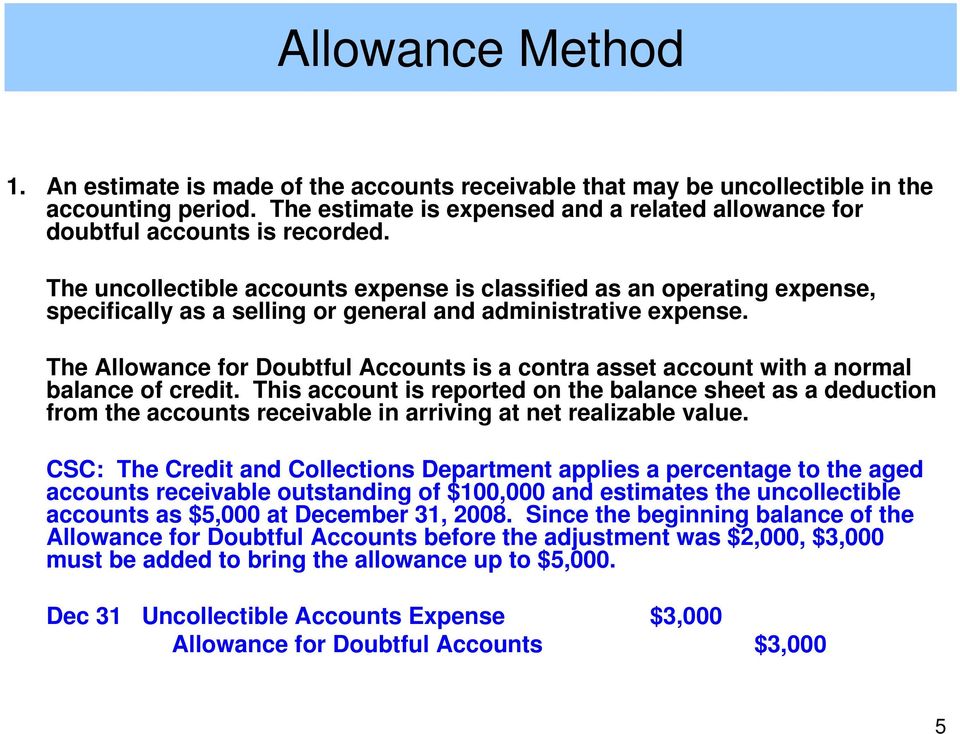

This can be done by reviewing historical data, such as customer payment patterns and trends in industry-specific metrics. When a lender confirms that a specific loan balance is in default, the company reduces the allowance for doubtful accounts balance. It also reduces the loan receivable balance, because the loan default is no longer simply part of a bad debt estimate. One method is based on sales, while the other is based on accounts receivable.

Balance Sheet Aging of Receivables Method for Calculating Bad Debt Expenses

This method involves estimating bad debts as a percentage of total credit sales. Businesses analyze historical data to determine an average percentage of sales that typically become uncollectible. This percentage is then applied to the current period’s credit sales to estimate the allowance. Incorporating an allowance for doubtful accounts is vital for transparent financial reporting.

New businesses must use industry averages, rules of thumb, or numbers from another business. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time.

An allowance for doubtful accounts is a contra account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid. The allowance for doubtful accounts estimates the percentage of accounts receivable that are expected to be uncollectible. However, the actual payment behavior of customers may differ substantially from the estimate. If a certain percentage of accounts receivable became bad debts in the past, then use the same percentage in the future.

Bad debt expenses, reflected on a company’s income statement, are closed and reset. Risk Classification is difficult and the method can be inaccurate, because it’s hard to classify new customers. As well, customers in any risk category can change their behavior and start or stop paying their invoices.