Assemble your earnings stubs, tax returns, and you may account passwords; the new think of homeownership for the eden can be you can with a few believe and you can exploration of the house capital process.

To find a house is sometimes one of the many instructions you will ever have, and with the mediocre transformation price of Their state unmarried-house nearing 1 million dollars, it definitely requires particular economic savviness. The following six procedures render an introduction to a mortgage conditions and advice into the planning a hawaii home get.

Step one: Finances. See what kind of cash you will be making per month (your income) as well as how far money you are investing (your own expenditures). To make a family group finances will assist know if you really can afford property today or how exactly to manage one in the near future.

Now, number in which their hard-gained money is invested per month. Kai and you will Pua purchase a significant amount spending rent due to their studio during the Honolulu, giving to their church, and you may rescuing to have retirement. They agreed to save well on enjoyment and you will dresses. Deducting its full income from their total expenses simply leaves these with $3000 every month to go into the its savings account, that can be used to possess an emergency and conserve having their residence advance payment.

Book = $1200Renters Insurance coverage = $20Utilities = $300Cell Cellular phone = $110Charity = $850Retirement Discounts = $700Food = $700Car Mortgage Commission = $400Car Insurance coverage = $120Student Funds = $200Medical = $300Entertainment = $400Clothing = $200

2: Help save getting a down payment, settlement costs, and you can extra costs. In Hawaii, the best deposit count was possibly 5% otherwise 10% of your purchase price to have a traditional loan; specific fund, such as for instance an excellent Va Mortgage, do not require any down payment, although some, you want more off. Such as for example, if you were to purchase property to possess $700,000 and you can called for 10% down, you’d you need $70,000 into down payment.

Tip: With the guarantee on your own latest family, pension offers, otherwise provide money, can also be an option to enhance your advance payment count and you can secure financial support or your brand new property. Speak to your mortgage advisor from the these types of solution investment solutions.

In addition to the down-payment, additional money required to own closing costs. Within the Hawaii closing costs usually were an escrow payment, name insurance policies, financial label insurance, a loan provider percentage, facts to your financing (for every point are 1% of the cost), assessment costs, closing set aside, taxation, repair payment (getting condo otherwise CPR), HOA import payment (to have condominium), and other charge. Getting good $450,000 business during the Waikiki that have month-to-month HOA charges away from $494, this new projected closing costs remain $9,five-hundred.

Recently detailed apartments within the Waikiki

Step 3: Assess estimated domestic payments. An on-line month-to-month house commission calculator helps you determine how much family you really can afford. Make sure you range from the adopting the, if the relevant on your formula:

Buyers’ Guide

- Financial dominating and you will appeal percentage

- Property taxation

- Insurance

- HOA/condominium charge

- Liquids, electricity, Internet, or other tools

- Fixes and you can upkeep

Carrying out the latest math on the will set you back out-of Hawaii homeownership ahead of to invest in, will help to assure you will be making a sound economic decision. Kai and you will Pua you will easily pay for a $3000 family percentage, making $1000 monthly because an urgent situation financing with regards to in past times spared i’m in desperate need of money currency.

Step: Be aware of the different varieties of mortgage loans. If you aren’t investing bucks for your home, you may need to borrow cash that have a mortgage loan. Discover different varieties of mortgage loans: fixed and changeable-rate; government-covered and traditional. Understanding the different types helps you weighing the advantages and you will cons and you will imagine that is right for your residence get.

Fixed compared to. Variable. A fixed-rate mortgage loan provides the same rate of interest and commission amount for the entire installment label.

A crossbreed make of fixed and variable mortgage loans ‘s the 5/step one Case mortgage, which includes a fixed rate of interest on basic five years right after which changes annually afterwards.

Government-Covered against. Old-fashioned Fund. You have got much more mortgage alternatives along with a fixed or changeable-speed home loan. A normal financing is not insured otherwise secured by government government however, often provided owing to personal lenders, instance banking institutions.

Government-insured funds become FHA loans, that allow down repayments as low as 3.5% and require financial insurance, Va money, that offer borrowers 100% capital due to their household get, and you may USDA/RHS finance, which are to have outlying consumers exactly who meet specific earnings requirements.

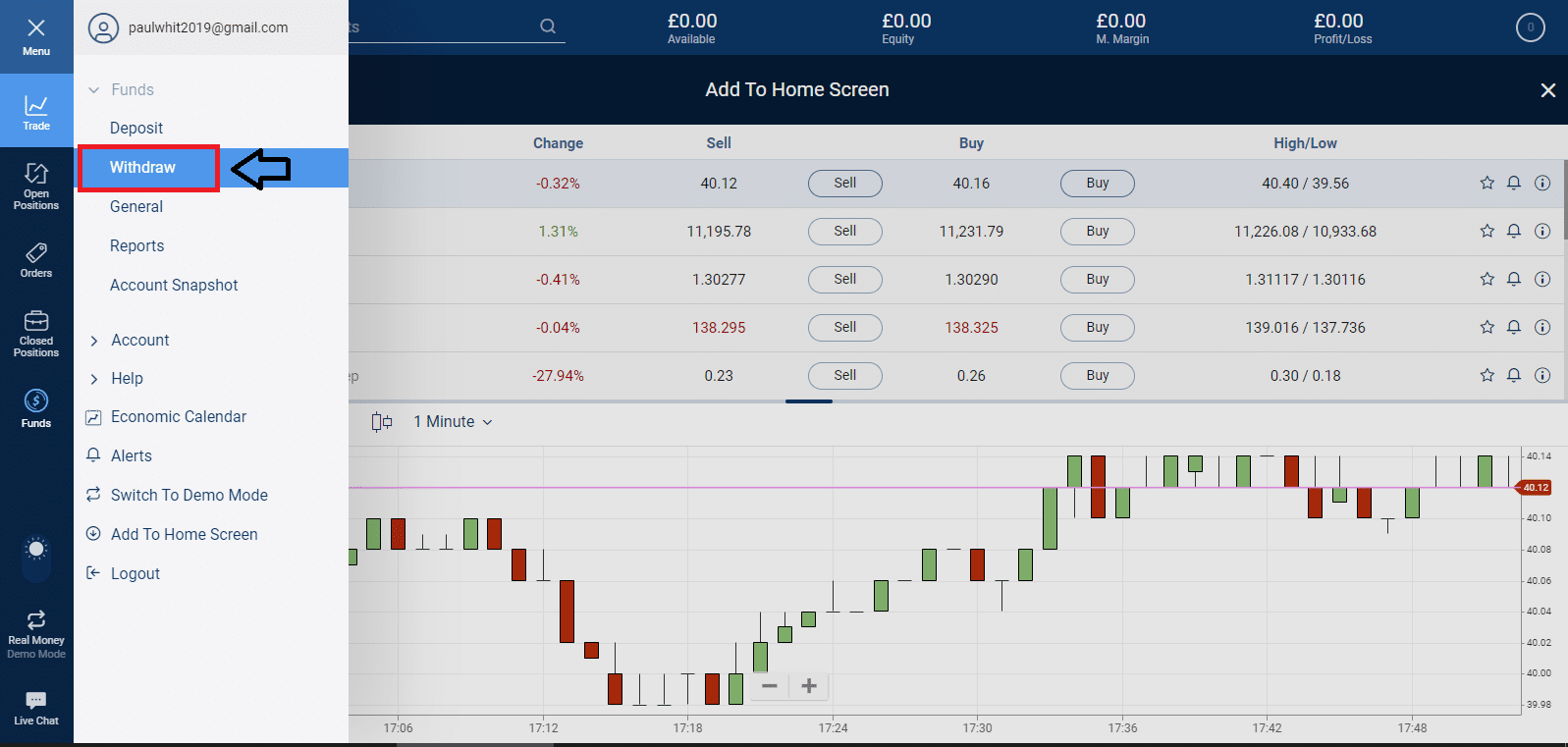

Step 5: Comparison shop having loan providers otherwise a mortgage broker. In the event the cash come in order and you are happy to initiate wanting property, it’s time to pick a home loan company, bank, otherwise mortgage broker. Like most larger purchase, it is important to check around and determine which option suits your needs.

A large financial company has numerous loan providers to help you just who they can fill in your loan software. They often discover an educated rates and you may lower fees and you will keeps best options for people with bad credit. They specialize in mortgages as they are usually experienced and you can work with multiple financing programs. Although not, they might not necessarily allow you to get the best bargain and sometimes charge higher costs.

Once you focus on banking institutions and you can direct loan providers, you don’t have the newest middleman large financial company, so sometimes you can prevent certain broker costs. As the loans are interior, processing is actually streamlined, and you may have the comfort at the office with your lender. However, extremely financial institutions convey more strict mortgage software and qualifying standards. In addition to, they don’t really work with several enterprises, so you could not have the lowest interest levels.

Step 6: Rating pre-approved. Once you have decided on an informed bank for you, it’s time toward pre-approval processes. Into the Their state, it is recommended for good pre-acceptance page just before wanting very first home. This letter offers a buyer an idea of monthly installments, down-payment standards, mortgage system words and it’ll help individuals mixed up in family get discover how much cash you could potentially dedicate to your residence, giving the provider so much more confidence in the a purchase render.

Buyers’ Publication

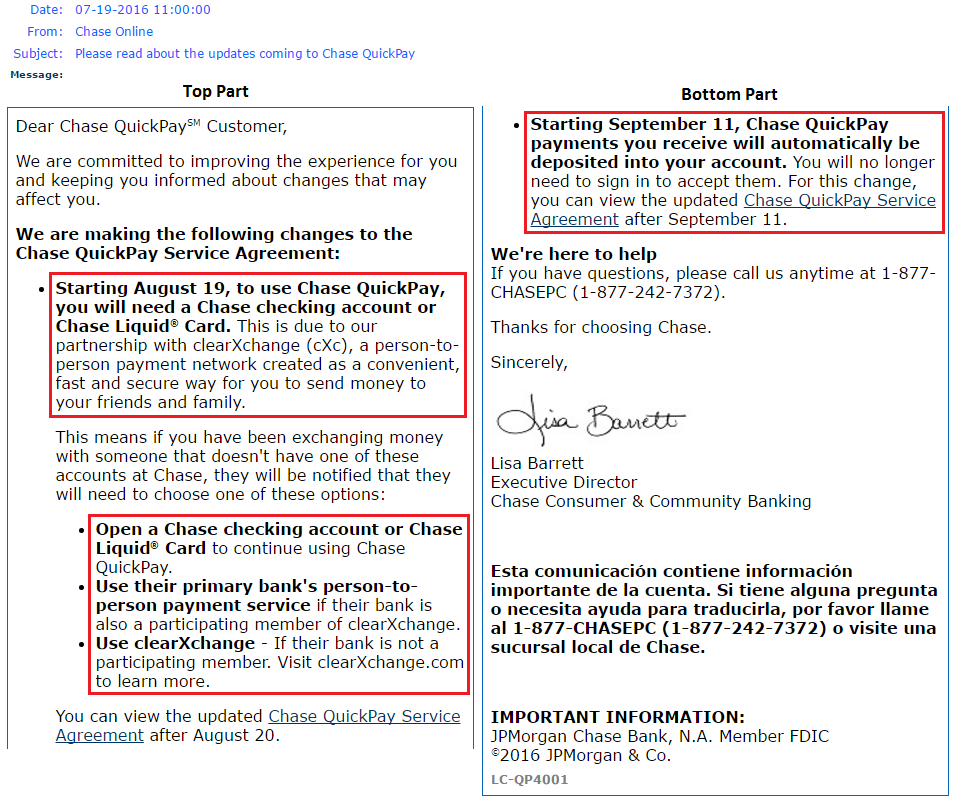

- Last couple of years out-of W2s and you can tax returns

- Several most recent pay stubs; or last one-fourth P&L report to own thinking-working people

- dos current comments getting bank, old age, and capital membership

How much money are you currently capable spend on brand new domestic? Your debt-to-earnings proportion (month-to-month borrowing from the bank and you will casing payments separated of the month-to-month earnings), credit rating, downpayment matter, property style of, and mortgage program all the basis to your deciding your final pre-approval number.