If you are looking to save money on the car finance repayments or rate of interest, or use even more money, you might be wondering do you really refinance an auto loan?

This new small response is, basically sure! You could re-finance an auto loan however, there are certain things you should believe prior to refinancing. Part of the concern you should ask are, usually the fresh refinance help you reach your economic desires, particularly:

- Saving cash;

- Borrowing from the bank more cash;

- Recovering mortgage enjoys; or

- Modifying lenders.

With those individuals causes planned, we have build brand new procedures to have refinancing an auto loan so you’re able to help you understand the process.

Step one: Create an appointment

To begin the method, have a chat with their lender. Additionally, it is good notion to create an announcement for your newest car loan too to help you explore your balance, rate of interest and costs.

- Are you presently entitled to re-finance?

- Are you paying any exit charges and other can cost you in order to pay-your established auto loan?

- Usually the fresh repayments match your finances?

- Have a tendency to people discount compensate for the price to re-finance?

2: Qualifications on the latest mortgage

If you have made a decision to use, the lending company will normally inquire about certain particular details about the qualifications to own another loan.

Eligibility

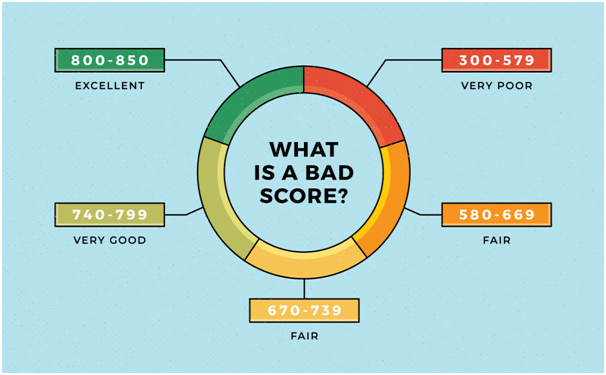

Refinancing a car loan is sometimes a highly comparable techniques due to the fact trying to get a different car loan. Possible generally need certainly to fulfill most of the usual qualifications requirements having applying for the brand new borrowing from the bank and earnings, expenses and you will a good credit score record.

Cover

The age of the car is also determine whether you’re permitted sign up for an auto loan otherwise a personal bank loan. Your own financial will let you see inside application.

For example, on Culture should your car is still seemingly the brand new (less than seven years of age) you happen to be eligible for a car loan. All of our Auto loan has a lesser rate of interest than simply our personal Loan since your automobile is used so you can safe the loan. When your auto is older you may want to instead need to pertain to possess a consumer loan. Your car or truck might still be used once the safeguards, however, as its worth might have decreased because you very first bought they, may possibly not totally secure your new loan.

Step 3: Rating support files to one another

When you find yourself application is looking great, you will need to get some good help files to each other for the financial. For people who haven’t currently, you would need to offer comments for your established car finance. Most other data files may be needed particularly spend slides, financial comments and you can proof of comprehensive car insurance whether your automobile will be made use of since the safeguards. If the applying during the Lifestyle, our personal Application for the loan Checklist helps you tick out-of exactly what you will need.

Step four: Finalise the job

In the event the loan is approved you are asked to acquire an enthusiastic formal payment shape to suit your existing auto loan of the getting in touch with their latest financial. you will need indication your brand-new borrowing offer. Make sure to realize and discover your own credit price information closely and that it all matches your own conversations together with your financial.

As soon as your software is processed your current car finance might possibly be given out and your the new loan will start. Definitely cancel people normal money toward dated vehicles financing and set right up payments for your the fresh new loan. If you’re considering refinancing your car or truck loan, the car loan repayments calculator or personal loan calculator can help you crisis the newest numbers. When you are ready to talk with Lifestyle Bank regarding your re-finance, inquire online, give us a call to your 13 14 twenty-two otherwise keep in touch with one of the group at the local department.