Whilst you can get qualify for some lenders that have less than perfect credit, you ought to assume highest rates. On the other hand, lenders can charge higher origination charge. No matter if tiny land are less expensive than simply conventional house, you might still you want funding to buy one to. If you have less than perfect credit you need to know renting a small home otherwise saving upwards enough cash to get one outright.

Another option you have is to utilize for a personal financing that have a cosigner. Obtaining an unsecured loan having a good cosigner can get raise your threat of approval. At exactly the same time, you can even be eligible for less interest rate. Ideally, good cosigner must have a good credit score and you may strong earnings. When the a beneficial cosigner keeps comparable or bad credit than simply on your own, they could maybe not boost your threat of recognition. Once you sign into the that loan which have a beneficial cosigner, you are equally guilty of installment. If you do not enjoys a ready cosigner, you may have to rebuild your credit before you apply for smaller household resource.

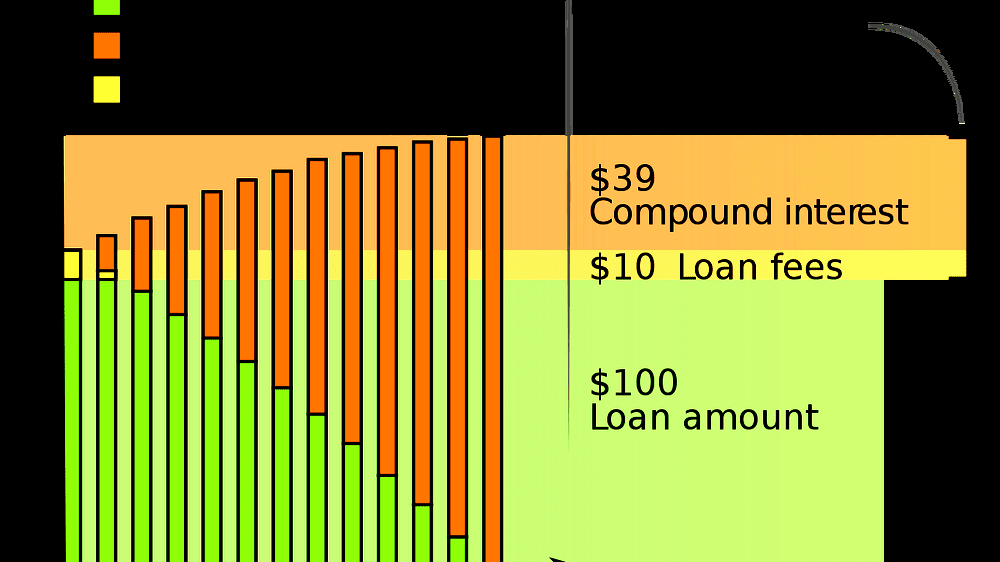

In terms of capital a tiny house, you’ve got so much more can cost you to adopt than simply the tiny house otherwise belongings by itself. While doing so, try to reason for financing charge in addition to attract to determine full mortgage will set you back. To determine total financing can cost you you can use an unsecured loan percentage calculator. For many who plug in the interest, identity, and you may amount borrowed, this new calculator can guess their payment per month given that really given that total financing cost. Keep in mind that when you can be able to shell out far more versus lowest payment, you might spend the money for financing off very early and you will save money. At the Acorn Finance, our lending lovers do not have prepayment charges.

Along with attention loan places Butler charge, you ought to see if discover other will set you back on the your loan. Certain loan providers may charge an enthusiastic origination payment private loans. Origination charges can be used for costs associated with handling the mortgage. In many cases they truly are called underwriting otherwise operating charge. Origination charges are a one-date prices one to ount. They are often subtracted about overall loan amount in advance of it’s funded. When comparing signature loans, you will want to contrast origination charges.

Sometimes, a person can need to convert to tiny house life style so you’re able to save money, pay loans, and you will reconstruct its borrowing from the bank

Along your loan name always hinges on the kind away from financing you use. If you utilize a consumer loan you may find loan terminology around a dozen decades. However, if you use a guaranteed mortgage you will probably find conditions upwards to 3 decades. This new conditions offered can also trust the quantity your obtain and you may everything be eligible for. As you are searching for the new longest term available, you have to keep in mind you to longer terms and conditions ple, what if youre given a seven year personal bank loan within 8.99% having $25,000. Inside circumstances, you’ll shell out near to $8,800 in notice once 84 paymentspare this to help you a ten-year consumer loan render in the 7.99% to possess $twenty five,000. Contained in this circumstance, you’d pay alongside $11,eight hundred into the notice just after 120 money. As the interest and you may payment was lower in the second condition, the complete financing cost is highest.

Is a tiny household cheaper than an apartment?

A tiny home are cheaper than a flat, it can depend for the multiple affairs such venue. At the same time, if you want to purchase belongings to store the tiny home into the, you ought to foundation it into your assessment too. It’s also wise to basis the fresh new profits on return. If you find yourself a condo could possibly get appreciate during the worthy of, a little house will most likely depreciate for the really worth.