Housing has become much more sensible than in the earlier point in time, because of the competitive credit cost within the nation. And, elite group loan providers or other financial institutions possess bolstered the convenience out of the entire process of getting houses finance. As a result, they yields consult amongst sensible, average, and superior sector consumers.

Getting your residence try unarguably an amazing profits and an excellent indication of stability and personal development. And you will, when you are delivering an excellent forty,000 salary within a month, the question you truly must be enduring was, How much financial should i get on good 40,000 paycheck? There are a number of things one determine your loan count, also to know it even more directly, we will talk about the extremely important considerations and skillfully suggested strategies to receive an amount borrowed effectively.

What is the limitation loan amount with a great 40000 income?

The amount of the borrowed funds you can found that have a month-to-month salary from ?forty,000 was purely determined by individuals factors. A person has accomplish every qualifications criteria, which include the fresh CIBIL get, newest a position condition, effective mortgage regarding borrower’s identity, and you will loan tenure. Generally, loan providers commonly choose for a financial obligation-to-money proportion laws to determine the amount borrowed for a particular candidate. And additionally, paycheck consideration is important because the lending company find the latest EMIs depending in your monthly money.

not, which have an income from 40,000, one could expect a loan amount varying between ?20 and you may ?twenty five lakhs having a tenure around 2 decades on a practical interest. Apparently, this type of numbers are very different dependant on the newest lender’s rules and include circumstances to look at if you’re giving the loan app. It is best to understand the eligibility standards a lender enjoys to follow, and smart believed is essential to have a smooth loan procedure.

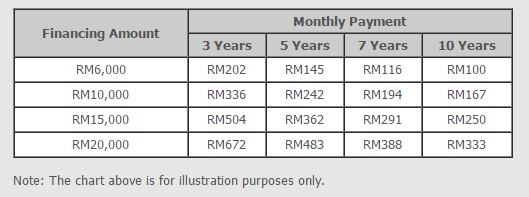

With an income out-of Rs 40,000, you can expect the second financing number out of various other banks:

Note: The second table brings a general imagine and you can genuine qualifications can get are different centered on personal things. It’s essential to personal loans online Arkansas consult a loan provider to have precise information.

How to evaluate my personal home loan qualifications?

The procedure of checking home loan eligibility involves numerous issues. This is the accurate make suggestions normally opt to pursue to own a soft loan application:

- On the internet Loan Calculators: Whenever you are in search of a reliable lender and you can visiting the other sites, you truly need to have noticed an excellent calculator readily available indeed there. Very loan providers and banks offer on the internet financial eligibility to help you enable it to be more relaxing for customers to evaluate that which you on their own. Very, you can capture next strategies properly.

- Evaluate your credit rating: You should keep examining your credit rating daily. Which have good CIBIL always pros your in a variety of ways. Together with, they advances your odds of bringing a silky financing procedure also from the absence of one necessary data.

- Get a monetary Advisor: With an economic coach by your side will assist you to secure a amount borrowed. Along with, he’s going to make suggestions to make top upcoming financial intentions to qualify for the required financing.

File Necessary for a mortgage

Files is actually a switch thought, especially when trying to get home financing. Data to make sure a lender the applicant can perform to make new month-to-month EMIs and will pay off the quantity as per the decided period. I have simplified the list of are not called for files less than:

Name and you can Residential Research: Speaking of a couple essential records one cannot skip to find an effective mortgage. You can look at demonstrating your passport, driving license, ID credit, Aadhar card, etcetera.

Income Facts: Inspite of the income you’ll receive paid for you personally, it usually is important to upload the income research. This will be wanted to assess what you can do to repay the borrowed funds. Along with, if you find yourself good salaried candidate, the financial institution or bank commonly ask you to publish your own salary glides.

Possessions Records: Regarding home loans, property data, and purchases plans, assets tax invoices, an such like., might possibly be expected as submitted towards on line loan application.