Ever since the financial crash out-of , borrowing from the bank profile management expertise have taken consideration within financial institutions attempting to end history repeating in itself. However, so it enjoy is not the just cause to handle financing. Financial institutions and you may financing company choose a loan profile administration program to handle chance, analyze their profiles, display screen their most recent points, and you can optimize winnings.

Due to the fact tech continues to create at the an actually-fast speed, far more businesses are onboarding technology alternatives, like Borrowing Collection Government (CPM) possibilities, to speed up and higher manage its mortgage profiles. Considering McKinsey, 60% of participants surveyed mentioned they enhanced the newest implementation from advanced logical units (AI, server discovering, etcetera.) over the past two years. Extreme 75% predict which trend to continue.

What exactly is a loan collection government system?

A loan collection government method is a form of app, utilized by economic regulators to deal with, screen, and you will get acquainted with their financing portfolio. Will called a good game-changer’ to possess organizations, it provides them the advantage to research an enormous list of research to send understanding. This permits better-level teams and also make so much more informed conclusion and pick any possible threats at the an initial phase.

Why does mortgage portfolio administration application really works?

Though borrowing from the bank profile management systems was indeed integrated into the newest monetary industries for a long time, the fresh new previous improves within the artificial intelligence and you may machine training technical provides determined possibilities pass significantly recently, with an increase of state-of-the-art tech emerging all round the day.

Credit portfolio management app draws on state-of-the-art financial models and you will predictive formulas to convert intense research with the actionable facts, and that’s tend to loaded with various designed keeps established towards business as well as particular means.

Just what key has actually is a practical loan collection administration program has?

When choosing that loan management application services, organizations usually become perplexed on variety of options into the sector. Which have expansive keeps all of the trying confirm its well worth, it can be difficult to get a hold of tailored equipment https://paydayloanalabama.com/pine-ridge/ in order to meet their demands. Let us crack they off to you personally.

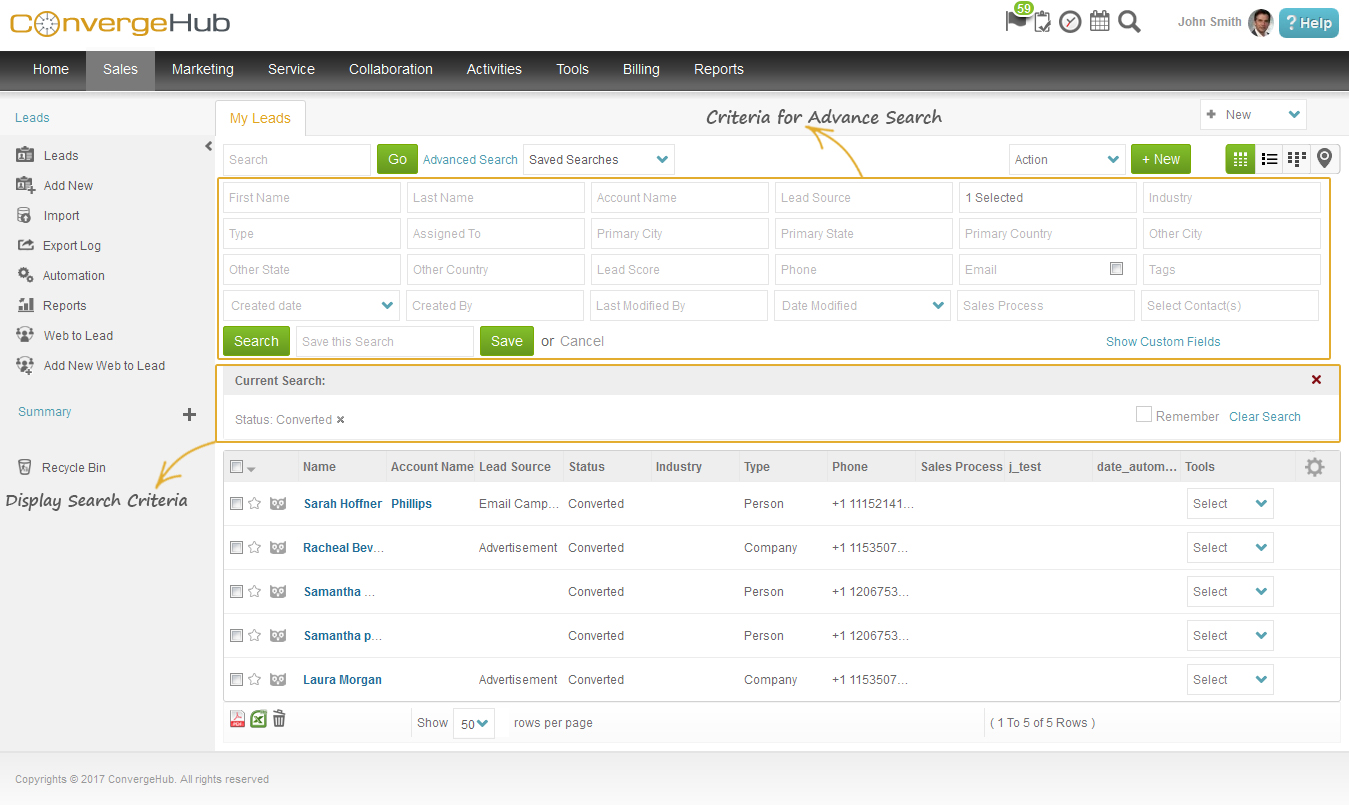

Financing tracking

Loan Administration System Review: Has & Conditions Seeing the latest figure from how the loans manage throughout the years brings insight into the health of your own portfolio helping pick early dangers. This allows organizations to save a firmer check out more than individual fund and take step rapidly would be to chance promote themselves. Predicated on data from the McKinsey, incorporate cutting-edge loan recording statistics will help to clean out non-payments because of the as much as 40%.

Commission control

When you look at the a modern-day solution simplicity-of-play with is vital so you’re able to working show. Commission operating solutions about mortgage collection management application enable it to be enterprises to help you techniques costs and do profile all in one place. That have an increase level of manage, it gets easier to do clients and you can cut the chance of standard.

Financial statement recording

Financing Government Program Manner: AI, Security & Conformity during the 2023 Predicated on Moody’s Analytics, the capability to get to know monetary comments is a priority in financing portfolio government. Performing this allows loan providers observe the new financial performance out-of individuals and work out more advised choices. In turn, so it reduces the overall risk of credit and you will provides a stronger portfolio.

Equity government

Utilizing collateral to safer financing isn’t really something new to most people. Actually, depending on the newest investigation, its one method to reduce default prices getting people and you can company loan providers. Inside a cards portfolio management program, guarantee government units monitor any guarantee offered which help would they your loans which were protected.

Covenant tracking

To own establishments interested in cutting default pricing and you will broadening efficiency, the ability to tune covenants was a prospective have to-have. Considering research by Accenture, addition of the product is an excellent answer to boost the top-notch credit. Covenant tracking essentially assists lenders so much more closely screen borrower compliance which have financing covenants and alerts if the something fails.

Chance review

Even if exposure are a natural element of one mortgage, borrowing should never be experienced also risky’. On most advanced technology easily accessible, companies are looking for the fresh an easy way to create often chance, assess the creditworthiness out-of customers and reduce its coverage inside their mortgage profile. It’s to-be a widely accompanied development so you’re able to automate and engage AI/ML tools for this reason. Instance, McKinsey listed that 31% away from SMEs interviewed stated it automatic the credit profile chance assessments, which have a life threatening change in recovery go out-to 37% claimed good 10% decrease in time called for.

Of the leverage cutting-edge technical and you may analysis-determined algorithms, we enable creditors and work out informed choices, do away with uncertainties, and you will enhance their credit profiles. During the a world where speed and reliability is actually important, looking at automation is key to unlocking this new opportunities and you may shielding long-term achievement.

Renewal automation

Financing renewal might be labor-rigorous getting profile professionals. Meanwhile, research has shown that the investment should be faster because of the 90%+, should your right technology is interested within best entry point to speed up the process. The issue is during debtor creditworthiness therefore the chance you to automobile-revived funds could have on the health of your own portfolio. Which have technical onboard to attenuate the brand new impact associated with, normally improve overall sustainability of the profile.

Success analysis

Providing probabilities and expertise into earnings out-of variety of financing, this particular technology reduces the risk of underpreforming profiles and you will increases the probability of starting fund. Like, enterprises may choose to consist of profitability ratios to their tech. These power tools display screen new monetary performance of your lender, and present knowledge in their power to make money and get winning.

Conformity administration

On the fintech globe, it nearly seems that regulating practices was changing in the an ever faster pace – sometimes even way more compared to this new tech world. That’s why when it comes to funds, businesses are prepared to get their hands on technical that not merely work, it is certified also. Because of the always after the upon the new regulating observes, enterprises can adjust and you will would the conformity requirement to make sure it get reduces chance and can cost you.

These are just a few of the devices which might be involved when designing a custom made or lowest-code program having mortgage portfolio government. As modern tools, significantly more selection usually appear, therefore be alert to which.