(1) Affiliate Funding Efforts

If the collaborative member could well be engaging in the management of the fresh organization, brand new members’ capital contributions usually are not noticed a protection.

(2) Donations

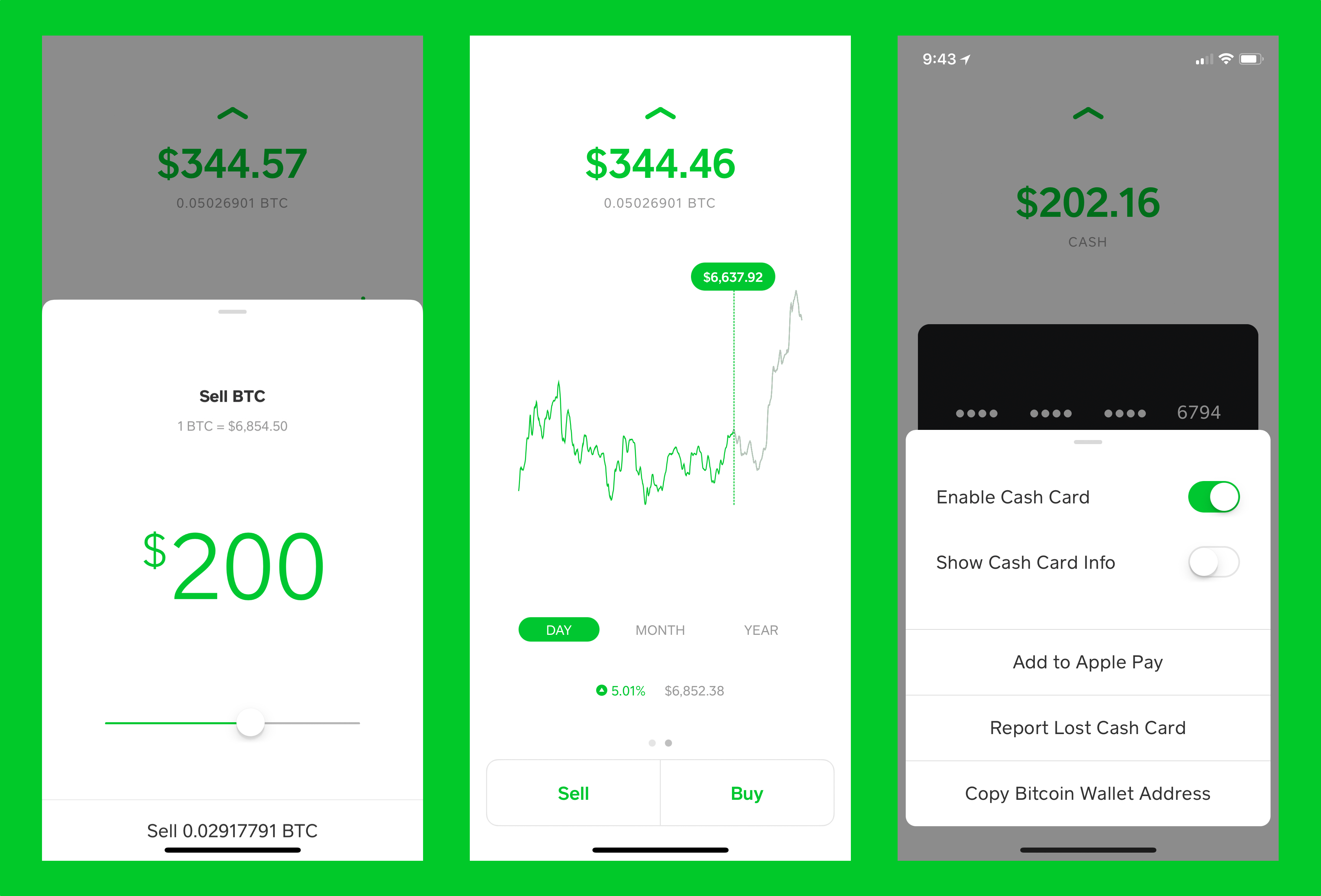

When anyone promote currency without any expectation out of choosing one thing in the return, he is giving. Of several entrepreneurs are using thus-titled crowdfunding other sites including Kickstarter and you will Indiegogo to increase money for various people. Entrepreneurs one personal installment loans for poor credit Portland solicit donations usually offer low-economic rewards so you’re able to donors.

Particularly, the latest Isla Horizon Eating Co-op launched Investment We Get it in the 2012 given that an attempt to order the assets. New National Cooperative Financial borrowed them $step one.dos billion for the buy in addition they effortlessly increased $two hundred,000 with the deposit owing to crowdfunding.

(3) Micro Money

If you find yourself traditional banking funds are now and again difficult for cooperatives to acquire, a choice try a small financing. A small financing was a small, low interest rate loan, offered due to some source. . Usually, the new teams that provide small fund are socially conscious about the fresh new difficulties one area entrepreneurs deal with of trying to secure funding.

Two samples of micro loan providers was Kiva Zip and dealing Choices. Group Work, an excellent cooperative home cleansers situated in San Jose, had a few effective Kiva Zero techniques during the 2012. They certainly were borrowed $10,000, sufficient working capital in order to promote healthcare for their professionals and you may build the membership. This informative article of Grassroots Financial Throwing brings a great overview of the procedure it went through to find a great trustee and you may creating the loan. Regardless if these types of finance can be very demanding, Kiva Zero requires the basic repayment in one month off disbursement, they are zero interest and certainly will work effectively to own coops one to has actually additional assistance.

(4) Pre-Offering

While an existing team and wish to expand your providers, you to possible way to boost financing is to try to pre-sell current permits. For example, you can offer a great $150 current certificate that a customer can be redeem at the providers, however, merely charges $100 for the present certificate. Battery charging lower than the worth of the fresh certification provides the client a supplementary added bonus to find the brand new present certification.

Come back of principle merely function offering right back the cash the funder offered, and not offering an income into financial support. Perhaps not providing a profit means that the business will not render any other thing more as compared to original money matter, such as a supplementary bonus, appeal, or appreciate during the value. It is very important note that, inside the California, it is likely considered a safety, therefore you should proceed with caution and you may talk to a lawyer if you choose to use this financial support means.

(6) Equipment Discounts

A different way to boost investment to suit your needs would be to charges a membership percentage and supply device discounts inturn. REI brings a fascinating model to possess unit savings resource. REI is actually a customers cooperative one deal subscriptions so you can their users. After the entire year, REI professionals receive a good dividend according to the matter invested on REI in 12 months. This dividend are able to be employed to shop at the REI.

(7) Bartering

You to definitely unique and frequently overlooked solution to gain necessary info is to stop money entirely definitely services and products otherwise features your organization needs. Bartering, or investing properties otherwise merchandise individually, was a means of acquiring info. If you want to raise currency to fund one thing particularly because the web design otherwise compostable glasses, think if or not you may be able to negotiate your items otherwise characteristics to find what you would like. This is not a classic setting utilized by businesses when money the providers; but not, it can be utilized alternatively supply of much needed tips to suit your needs. Although not, you should keep in mind that bartering are subject to tax.